Transformation on the Freshwater Fish Marketing Corporation: Ministerial advisory panel

On this page

- Executive summary

- 1 Introduction and purpose

- 2 Ministerial Advisory Panel

- 3 Background on the inland fishery

- 4 Co-operatives

- 5 Engagement

- 6 Observations

- 7 Recommendations

- 8 Conclusion

- 9 References

- Appendix A: Canadian inland fishery

- Appendix B: Ministerial Advisory Panel

- Appendix C: Engagement materials

Executive summary

On September 21, 2018, the Honourable Jonathan Wilkinson, Minister of Fisheries, Oceans and the Canadian Coast Guard, announced the establishment of a Ministerial Advisory Panel (Panel) to examine alternative governance and ownership models for the Freshwater Fish Marketing Corporation (FFMC) which better reflect the environment and market conditions in today’s industry. The Panel was directed to explore models that support collaboration and co-operation amongst fishers and involve them in decision- making. As part of its review, the Panel was also asked to assess opportunities for partnership arrangements with organizations that could play a role in the inland fishery.

The Panel completed engagement activities that focused on exploring in greater depth the key conclusions from the 2017 engagement process and hearing from stakeholders their perspectives on alternative governance and ownership models that might support opportunities for collaboration and co-operation among harvesters. The Panel was also interested in hearing from stakeholders about the role they felt they could have in the implementation of these models. The Panel acknowledges with gratitude the substantive commitment and contribution of so many individuals and groups willing to share their perspectives on the future of FFMC.

The Panel identified stakeholders within each of the active jurisdictions that FFMC currently operates within or remains a signatory to the FFMA. These stakeholders included FFMC senior staff, active commercial fisher organization representatives, regional Indigenous leadership, provincial and territorial government representatives, national fishery associations, and other stakeholders with a keen interest in the future of FFMC.

The recommendations address the mandate and objectives provided by the Minister, take into account the current economic and biophysical environment, recognize the factors driving change in the fishery, address the interests and issues identified during the Panel’s interactions with stakeholders, and consider supporting documentation and discussion among panel members.

The Panel’s recommendations underline the need for change. Manitoba and Saskatchewan’s withdrawal from the FFMA in recent years, increasing concerns about the biomass and sustainability of the fish resource, and changes in the marketplace including consumer preferences all indicate that the current structure of the inland fishery is no longer suitable to meet the needs of those with a stake in the fishery.

The Panel’s recommendations are designed to provide a highly structured process within which stakeholders can resolve their differences and reach a decision they all support. The Panel’s recommendations are also designed to develop outcomes that support meaningful opportunities for collaboration and co-operation among harvesters, integrate the needs of Indigenous fishers and their communities, and support self-determination. To this end, the Panel recognizes the process will need support and identifies the requirement for sufficient independent process support from the outset and throughout the process.

The Panel’s recommendations describe a three-year process that involves immediate changes to the governance of FFMC in Year 1, human and organizational capacity development in Year 2 and completion of a path forward in Year 3.

Year 1 would focus on immediate changes to the governance of FFMC to increase fisher participation, improve communication, and integrate fisher perspectives in decision-making processes. It would also implement process support resources through the appointment of an interlocutor.

Year 2 would focus on the implementation of capacity development activities that improve the capacity of stakeholders to work collaboratively and co-operatively, and provide opportunities for fishers to learn more about the open market environment and the operational implications of a co-operative model.

Year 3 would focus on the interlocutor’s confirmation and implementation of a transformation objective and the completion of the implementation process.

The path forward will be defined by the participation and success of all stakeholders. The Panel has concluded that the collective interests of commercial fishers and stakeholders would be best realized through the establishment of a New Fisher Organization. This entity would take over some or all the activities of FFMC and would be structured as a business federation of regional fisher groups and/or processors. This structure would accommodate different regional perspectives and interests while achieving economies of scale in processing and marketing.

If a New Fisher Organization cannot be successfully formed, the Panel has identified that an Indigenous Economic Development Corporation may be a suitable alternative for stakeholders in capturing the greatest value for fishers. An Indigenous Economic Development Corporation would provide Indigenous ownership, be of national scope, and extend the existing model with opportunities for Indigenous development and training.

If neither a New Fisher Organization nor Indigenous Economic Development Corporation model are suitable, options for the future of FFMC are more limited, with each having considerable challenges. Alternatives could include: (a) identifying ways to support the existing FFMC system; (b) dissolving FFMC through the sale of assets and/or specific areas of operations; and (c) ceasing FFMC operations outright.

The inland fishery is an important element of Canada’s character and holds particular importance with Indigenous peoples and in northern and remote communities. The Panel has identified a structure that reflects the considerable value of the fishery, provides for people most closely linked to its success to be involved in future decisions and planning, and ensures future generations have the opportunity to participate in the inland fishery.

The Panel feels that its recommended plan addresses the concerns and uncertainties identified by stakeholders and by the Panel in its review.

The plan provides for the implementation of a defined set of activities over three years. It involves all stakeholders in the planning and implementation process, which in turn provides for the greatest potential for agreement and success.

The plan is practical and effective and is respectful of the status of Indigenous communities and the role the inland fishery has for these communities. It includes provision for process support throughout, along with a comprehensive communication plan to share information and receive regular feedback on process status.

1 Introduction and purpose

On September 21, 2018, the Honourable Jonathan Wilkinson, Minister of Fisheries, Oceans and the Canadian Coast Guard, announced the establishment of a Ministerial Advisory Panel (Panel) to examine alternative governance and ownership models for the Freshwater Fish Marketing Corporation (FFMC) which better reflect the environment and market conditions in today’s industry. The Panel was directed to explore models that support collaboration and co-operation amongst fishers and involve them in decision- making. As part of its review, the Panel was also asked to assess opportunities for partnership arrangements with organizations that could play a role in the inland fishery.

This is the Panel’s report to the Minister. It describes the process the Panel followed and the Panel’s observations and recommendations for the transformation of FFMC.

Canada’s commercial inland fishery is critical to the economic and social fabric of many communities in western and northern Canada. While FFMC has long played an important role in the freshwater fish market in this region, conditions in the industry have changed, and with them the need for changes to FFMC. The Panel is confident that its recommendations will help the Government of Canada determine the future of FFMC.

This report provides background information relevant to this complex issue and summarizes the activities and outcomes from the Panel’s engagement process. The report provides observations on issues relevant to the current and future state of the freshwater fishery affected by FFMC. Finally, the report provides recommendations on a possible course of action for transforming FFMC, including implementation and capacity considerations.

1.1 The Freshwater Fish Marketing Act

A major impetus for the appointment of the Panel was the decision by the Manitoba government to withdraw as a signatory to the Freshwater Fish Marketing Act (FFMA) in 2017. The Manitoba government’s decision was preceded by decisions by Ontario (2011) and Saskatchewan (2012) to withdraw from the FFMA, and by Alberta (2014) to close its commercial in-land fishery. The Manitoba decision meant that, except for the Northwest Territories (NWT), FFMC’s operating environment is now entirely an open market.

The move to an open market is a major change for FFMC, which operated since its inception in 1969 as the sole buyer of freshwater fish in Northern and Western Canada and Northern Ontario and as the single-desk seller of Canadian freshwater fish in international markets. FFMC now faces potential competition from other large fish processors and marketers and must deal with the consequences of fishers who are free to sell their fish privately or to develop local and regional fish processing operations. While FFMC’s Crown corporation structure was necessary for its operation as a sole buyer and single-desk seller, it is not necessary to operate in an open market. As well, as the cases of hogs and wheat have shown, the retention of the Crown corporation status is often viewed by private sector players in the market as being detrimental to their interests. These factors, along with rapidly changing consumer demand for fish products, are behind the desire to examine the future of FFMC.

FFMC was created in 1969 as a result of the passage of the FFMA. The FFMA was the major legislative outcome of the 1966 Report of the Commission of Inquiry into Freshwater Marketing (McIvor Report). The McIvor Report concluded that fishermen received an unduly low price because of a lack of bargaining power:

“The Commission finds that overall the weakness of the fisherman in the western inland fishery and in Northern Ontario is particularly appalling. Many fishermen in Manitoba, Saskatchewan, Alberta, Northern Ontario and the Northwest Territories, mostly Indian or Métis, lack the training for and have no alternative employment. During the fishing season, they must fish or remain idle. Many are located on small lakes in remote areas and usually have only one buyer for their fish.

Because the fisherman lacks the capital and in order to assure a supply of fish, the buyer equips many fishermen with a boat, motor, nets, fuel, food, etc. At the end of the fishing season, the buyer indicates whether the value of the catch was sufficient to pay for the rental of the equipment and the cost of the supplies. Often it is not, and the fisherman remains in debt until the coming season.

We find that under these circumstances, the fisherman is essentially an indentured labourer for the fish companies. It is self-evident that fishermen in this situation do not negotiate a price.

There is no bargaining. The fisherman’s prime concern is existing.”Footnote 1

The McIvor Report also noted that fish processing was spread across several independent processing plants, reducing efficiency overall in the industry. FFMC was established and given its single-desk selling powers to deal with these issues.

The conditions described above are relevant to the Panel’s deliberations. As will be discussed below in more depth, fishers in remote areas expressed deep concern that they would be faced with few, if any, buyers if FFMC were no longer in operation. As well, the Panel heard evidence from numerous local and regional groups of their desire to develop small-scale processing operations to take advantage of opportunities that emerged with the opening of the market. While the Panel will outline ways of dealing with these challenges, it is important to stress that similar conditions to what was experienced prior to the establishment of FFMC (fewer or no buyers, processing inefficiency compared to the marketplace, and increased challenge to fisher exercise of self-determination) will emerge if appropriate steps are not taken.

2 Ministerial Advisory Panel

2.1 Panel members

The Panel consists of six members, including a Chairperson, and reflects a diverse group of representatives with expertise and experience in

- fisheries and market development

- fisheries management

- indigenous community and economic development

- co-operative and collaborative governance

Background information of each panel member is included in Appendix B.

2.2 Mandate and timeline

The Ministerial Advisory Panel was established in September 2018 to provide a report on how to transform FFMC’s governance and ownership model. In this context, the Panel was to

- explore in greater depth the ideas heard through the FFMC 2017 engagement process

- explore and analyze alternative governance and ownership models that support opportunities for broad-based collaboration and co-operation amongst harvesters, including shared decision- making

- assess opportunities for new partnership arrangements through focused engagement with organizations which could play a role in the implementation of these models

- present the Minister with its findings and provide options with respect to a course of action for transforming FFMC, including implementation and capacity considerations

In providing its options, the Panel was guided by the following priorities:

- supporting the long-term viability of the freshwater fishing industry in Manitoba, Saskatchewan and the Northwest Territories

- supporting opportunities for all fish harvesters in these jurisdictions, including those in northern and remote communities, to bring their catch to market

- recognizing the needs of Indigenous fishers and their communities and supporting self-determination

3 Background on the inland fishery

The following sections provide background information relevant to the Canadian inland fishery.

The Canadian inland fishery has seen major changes over the last ten years, including the withdrawal of all but one of the signatories to the FFMA, operational changes within FFMC, and changes in the marketplace and consumer preferences.

Section 3.1 provides background information about FFMC, including its mandate, operations, issues and challenges and current status. Section 3.2 reviews the state of the Canadian inland fishery, focusing on existing FFMC areas of operation. Section 3.3 provides information on the marketplaces in which FFMC operates and highlights the efforts FFMC has made to develop products for international markets as well as develop markets for FFMC fish products.

3.1 The Freshwater Fish Marketing Corporation

FFMC was established in 1969 in response to findings published in the McIvor Report with a mandate to

- purchase all fish offered to it for sale

- market fish in an orderly manner

- increase returns to fish harvesters

- promote international markets for freshwater fish

- increase interprovincial and export trade in fish

At the current time, the FFMA provides FFMC the exclusive right to market and trade designated freshwater fish products supplied from NWT. FFMC is also the dominant buyer, processor and marketer of freshwater lake fish from Manitoba and Saskatchewan, although these jurisdictions are no longer signatories to the FFMA.

FFMC has provided effective market access and a reliable source of income to the commercial fishers of western and northern Canada for 50 years. In fulfilling its mandate, FFMC provides four key benefits to the inland fishery as well as domestic and global food markets:

- orderly market and price maintenance: FFMC buys all fish offered for sale and carries out market- stabilizing activities such as storing frozen inventory to match supply with demand

- global markets: FFMC gives western and northern Canadian inland fishers access to global markets while reducing the business risk for fishers inherent in the export of food products, including the following:

- foreign exchange risk - by hedging U.S. dollars

- market risk - by setting buying prices for a season and as much as possible for a year at a time

- cash flow risk - by paying fishers within a week of delivery and managing customer receivables

- food safety and security: FFMC works closely with the Canadian Food Inspection Agency and its customers to ensure its supply chain and processing plant meet federal and customer requirements for food safety and security

- economic development: Approximately 80% of FFMC’s returns to fishers and agency fees go to isolated northern and predominantly Indigenous communities.Footnote 2 A majority of these communities (42 of 49) are predominantly Indigenous

3.1.1 Current operations and planning objectives

FFMC operates an extensive supply chain of delivery points, agents, temperature controlled transport, and processing and inventory management systems to match a fish harvest of over 1,600 commercial fishers with market demand.Footnote 2

Contracted agents and corporate agencies act on behalf of FFMC across Manitoba, Saskatchewan and NWT. FFMC staff post initial prices for harvesters and manage nearly 50 delivery points to collect, purchase, ice, pack and transport fish to the federally certified FFMC-owned facility in Winnipeg for processing and sale. The fish is then sold fresh or frozen, whole or processed, minced or as fillets. FFMC also sells other fish products, including caviar.Footnote 3

FFMC uses a two-stage structure to provide payments to harvesters. Initial prices are based on operational forecasts prepared by management. FFMC provides fish prices to harvesters before the start of the fishing season (in March or April) and pays them upon receipt of the fish. Final payments, which are paid to harvesters after the marketing is completed, are determined in accordance with FFMC’s retained earnings policy and by allocating profitability by species of fish. The Board of Directors approves both the initial prices and the final payments.Footnote 4

FFMC also provides important services to these communities. Current services offered by FFMC include

- seasonal loans and / or credit advances to harvesters at the beginning of each season for new equipment

- field operations to support the harvesting network and manage the fish packing facilities

- employment insurance administration and tracking

- freight coordination

- FFMC’s barges help deliver food, diesel and other necessary supplies to isolated communities

FFMC’s Corporate plan FY 2018-19 to 2022-23 reflects input from employees, management, Board members, fishers and key stakeholders which is then consolidated into the following strategic goals:

- generate market value and leadership in the markets it chooses to serve

- manage an effective and efficient supply chain and be the preferred choice for fishers

- continue to improve stakeholder confidence by improving the financial position of the Corporation

- maintain corporate viability and sustainability

- establish a culture of performance delivering an exceptional workplace to employees and value to fishersFootnote 5

3.1.2 Current issues and challenges

Many of the issues identified in the McIvor Report remain relevant today. For example, fishers work hard to land their catch and are concerned about the returns achieved for their effort. FFMC’s extensive supply chain provides a mechanism to return the value achieved in the market to the fishers who supply the fish. In the 1960s, fishers bore the cost of fish spoiling through improper freezing and transportation. Fish were also subject to high processing costs from many small fish processing plants. Transportation and processing costs for fish are still significant factors in the profitability of harvesting and marketing, but FFMC achieves processing efficiency by centralizing fish processing in Winnipeg.

Currently, the United States is the largest market for Canadian-caught freshwater fish. However, FFMC has actively sought to expand to new markets outside the United States. FFMC is the largest supplier of Northern Pike in France and of Whitefish in Finland and Sweden, and distributes fish products to a total of 14 countries in North America, Europe and Asia.

Management issues

In 2017, the Office of the Auditor General released a special examination report on FFMC, finding significant deficiencies in its systems and practices for corporate management and management of operations. These findings echoed those of a 2011 special examination, which in turn followed suggestions in 2005 for management improvements.Footnote 6

In response to recommendations provided by the Auditor General’s Special Examination report recommendations, FFMC publishes progress on its ongoing initiatives to improve governance and management practices, risk monitoring and strategic direction. The Corporation has developed a risk profile, re-examines risks as new issues emerge and focuses activities accordingly. It has developed a set of key performance indicators to monitor ongoing corporate performance in a variety of areas and publishes the results of this performance in its public reports. Finally, it has developed an internal communications system to ensure that employees are aware of changes that affect the organization, and are trained and compliant with relevant regulations and policies.Footnote 3

Loss of provincial mandate

Over the past decade, all of the provincial jurisdictions in which FFMC operates have chosen either to withdraw from the FFMA, or to close their commercial fishery altogether. Ontario withdrew from the FFMA in 2011 in favour of an open market. Since then, a small amount of fish harvested in Northwestern Ontario has occasionally been sold through FFMC. Saskatchewan followed Ontario in 2012 and withdrew from the FFMA. Alberta announced its intention to close its commercial fishery in 2014, but remains a signatory to the FFMA. Manitoba withdrew from the FFMA on December 1, 2017, to create an open competitive market. NWT is the only remaining jurisdiction active in the FFMA.

Governance

Currently, FFMC Directors are appointed by Order in Council. According to the FFMA, the Chair and President of the Corporation are appointed by the Governor in Council, and four directors are appointed on the recommendation of the Minister of Fisheries and Oceans. In addition, one director is appointed for each participating jurisdiction by the Governor in Council on the recommendation of the respective province or territory (Freshwater Fish Marketing Act).

FFMC’s Board acts as the trustee on behalf of the government by holding management accountable for the Corporation’s performance, its long-term viability, and the achievement of its objectives. It is responsible for ensuring that the Corporation is managing its assets and its human and financial resources in accordance with professional best business practices and standards.

Fisher interests

Fish harvesters in FFMC’s jurisdictions have expressed dissatisfaction with FFMC’s accountability structure. Many fishers feel disconnected from senior FFMC staff and management and are concerned that decisions are not communicated by the upper management. The perceived lack of communication has fueled a sense of distrust among fishers. Overall, fish harvesters feel there needs to be increased transparency from senior officials and more fisher representation in decision-making.Footnote 7

Fishers feel that FFMC could better recoup the trust of fishers by changing governance practices and incorporating local knowledge practices into decision making. Many also believe that the price they receive from FFMC for their fish has remained stagnant over the years. Fishers feel FFMC could deliver better prices to fishers through renewed marketing efforts and a leaner management structure.Footnote 7

Increased competition and processing capacity development

FFMC has already experienced challenges securing reliable supplies as a result of the entry of private buyers in Manitoba and Saskatchewan. New entrants to date have focused on readily accessible and desirable species such as Pickerel.

Manitoba and Saskatchewan’s withdrawal from the FFMA has provided risks and opportunities to FFMC. Competitors are now free to purchase fish harvested in these provinces. Continuity and reliability of supply is a risk. FFMC has sought guaranteed multi-year supply contracts with fishers, fish agents and fish co-operatives to help secure raw material to meet market commitments and maintain the value and efficiency of its assets. Under the FFMA, FFMC continues to be obligated to purchase all fish legally offered for sale in NWT and Alberta.Footnote 8

The arrival of the open market has also placed increased pressure on existing processing efficiency. All jurisdictions in which FFMC is currently active operate or have plans to develop additional fish processing facilities.Footnote 9 New regional processing capacity may divert fish supply away from the main Winnipeg processing facility. This may lead to reduced plant operation efficiency.

3.1.3 Status of the Freshwater Fish Marketing Corporation

In light of Manitoba’s withdrawal from the FFMA, FFMC’s management challenges, and the new competitive market in which FFMC is now operating, the Corporation has established three- to five-year supply contracts with fishers in Manitoba and Saskatchewan, and has developed species-specific marketing strategies. FFMC’s overriding objective is to provide the core activities of its legislated mandate.

3.2 The Canadian inland fishery

3.2.1 Overview

The majority (80%) of commercial harvesters in FFMC’s mandate regions are First Nations or Métis. While the inland fishery represents an important source of revenue for many harvesters and the communities in which they are located, most harvesters are not able to earn a living solely from the revenue they obtain from the sale of freshwater fish. Generally speaking, Indigenous harvesters are more dependent on fisheries and more economically disadvantaged than non-Indigenous harvesters.

Beyond formal market value, commercial fishing in FFMC’s regions carries significant social and cultural importance. Subsistence harvesting of freshwater species, particularly in Indigenous communities, provides food to community members, the provision of linkages to traditional lifestyles and ancestors, and socialization.

Appendix A provides additional information on the inland fishery in NWT, Alberta, Saskatchewan, Manitoba, and Ontario.

3.2.2 Production

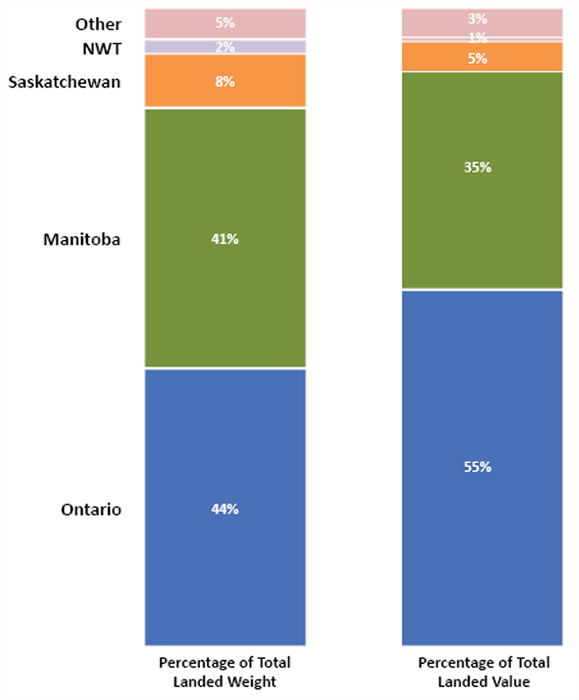

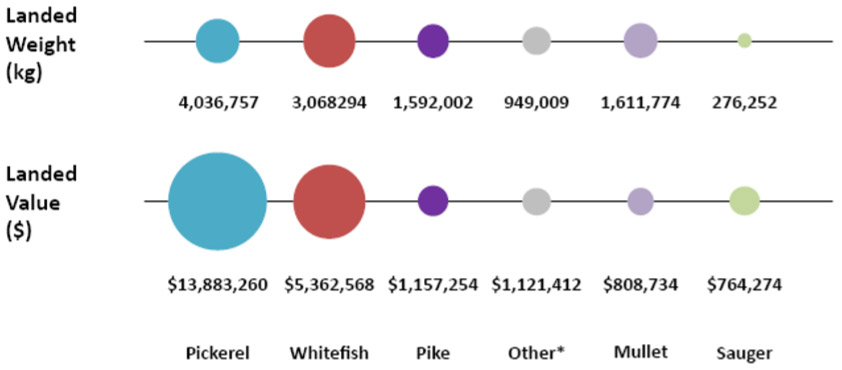

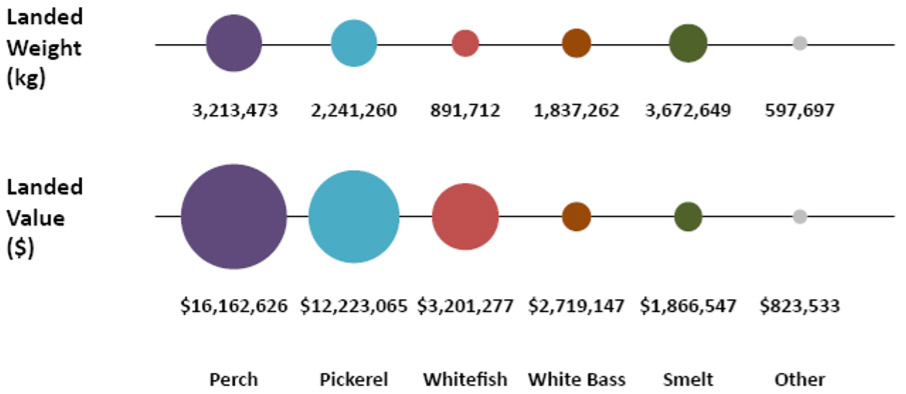

Canada’s inland fishery produces approximately 28 million kilograms of freshwater fish each year with a landed value of $67 million.Footnote 10 Ontario and Manitoba are the highest production jurisdictions, at a combined 84% by weight and 90% by total value.Footnote 11 Saskatchewan, NWT, Quebec and New Brunswick also maintain commercial freshwater fisheries.Footnote 12

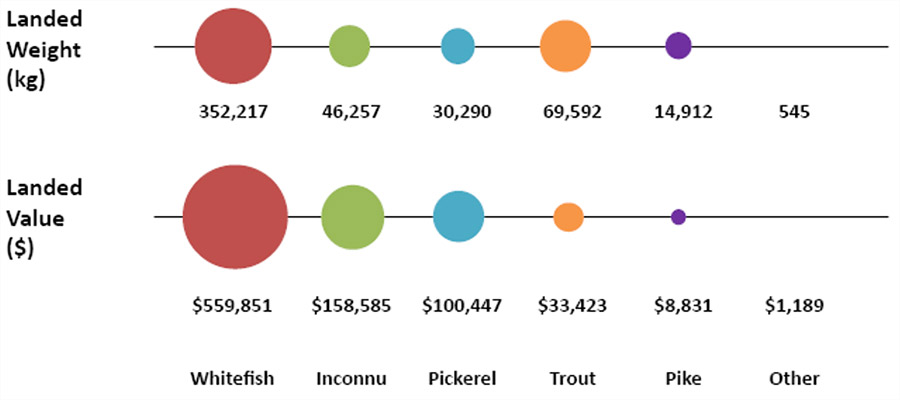

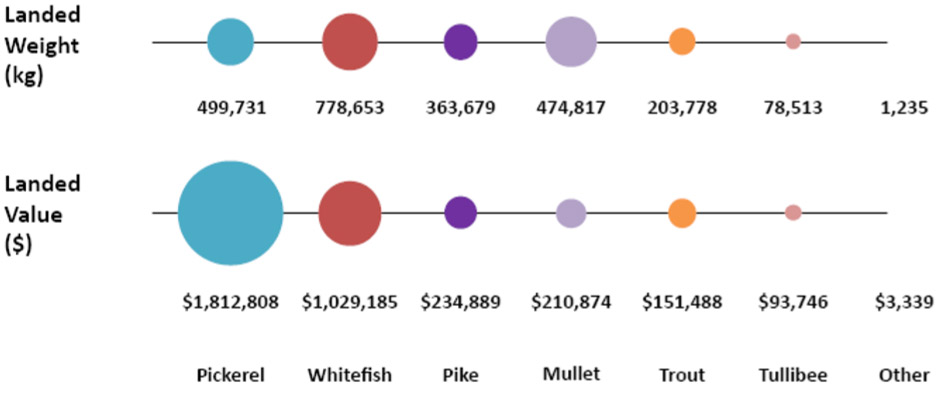

Source: DFO, Freshwater Landings

Long description

Average contribution to total Canadian landed weight and landed volumes of commercially caught freshwater fish for Canadian provinces from 2014 to 2016 are shown. Ontario produced 44% of total landed weight, while Manitoba produced 41%, Saskatchewan produced 8%, Northwest Territories produced 2%, and 5% came from other provinces. Ontario produced 55% of total landed value, while Manitoba produced 35%, Saskatchewan produced 5%, Northwest Territories produced 1%, and 3% came from other provinces.

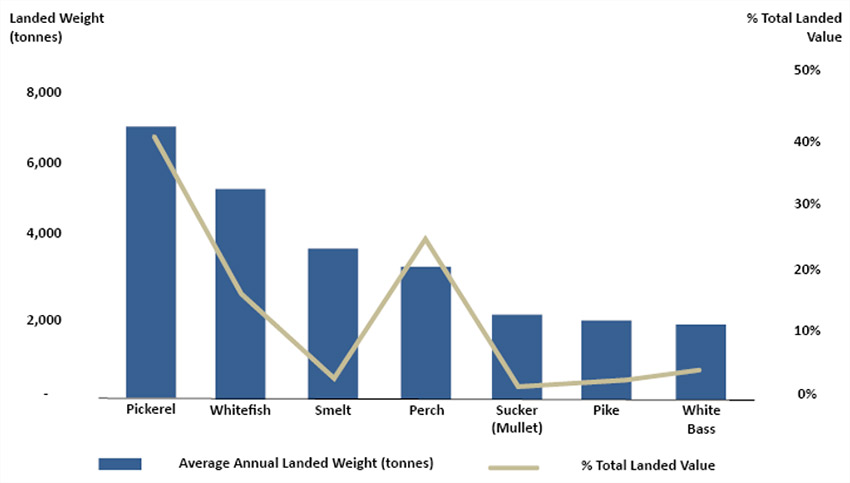

The most important species to the inland fishery are Yellow Pickerel (also referred to as Walleye), Lake Whitefish (Whitefish), Smelt, Perch, Sucker (Mullet), Pike, and White Bass. Together, commercial harvest of these species comprised 87% of total freshwater landed weight, and 92% of total landed value between 2014 and 2016.Footnote 11 Other freshwater species harvested in Canada include Arctic Char, Burbot, Catfish, Eel, Rock Bass, Salmon, Shad, Sturgeon, Sunfish, Tomcod, Sauger, Tullibee, Lake Trout and Rainbow Trout.

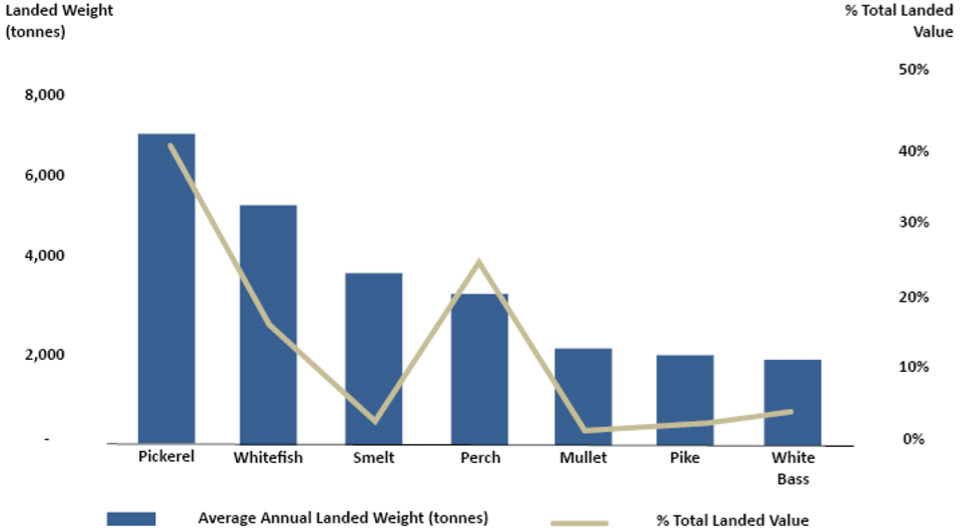

Source: DFO, Freshwater Landings

Long description

Average annual landed weight, measured in tonnes, and contribution to total Canadian landed value from 2014 to 2016. In order of largest to smallest volume, Yellow Pickerel (Walleye) landed weight was 6, 815 tonnes, Whitefish was 5,186, Smelt was 3,684, perch was 3,289, Sucker (Mullet) was 2098, Pike was 1,991, and White Bass was 1,878. The percentage of total Canadian landed value for Yellow Pickerel (Walleye) was 41.8%, while it was 15.6% for Whitefish, 2.8% for Smelt, 24.5% for Perch, 1.5% for Sucker (Mullet), 2.1% for Pike, and 4.1% for White Bass.

3.2.2.1 Trade

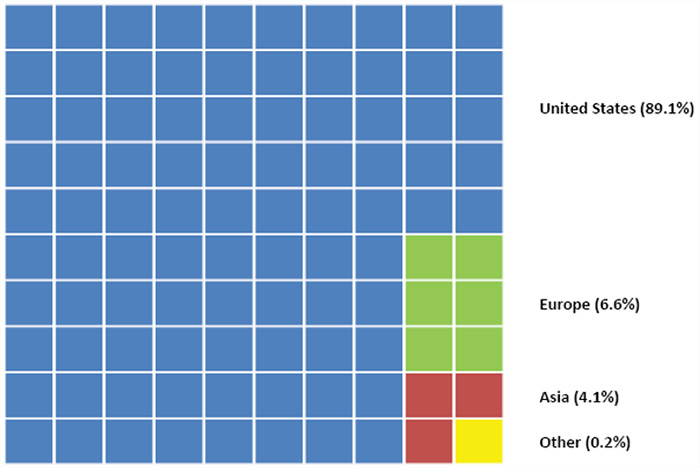

For the 2014-16 period, average annual sales of processed freshwater fish products were valued at approximately $135 million.Footnote 13 While there is a domestic freshwater fish market, the majority of production is exported.

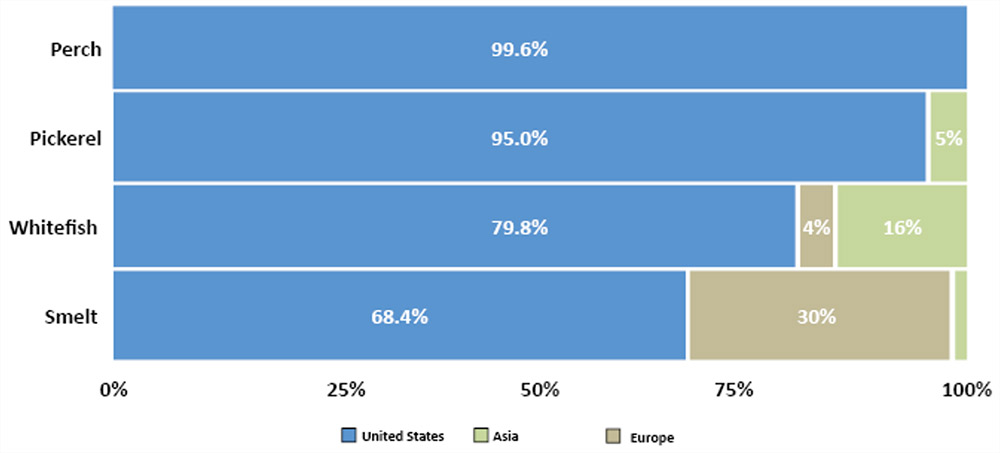

Source: DFO, (2018) EXIM, Ottawa. Countries included in each regions are provided in Table 3 (References).

Long description

The contribution of international regions to exports of Freshwater Fish from Canada from 2014 to 2016 are depicted. 89.1% of the value freshwater fish exports was exported, while 6.6% was exported to Europe, 4.2% was exported to Asia, and 0.2% were exported to other countries.

Source: DFO, (2018) EXIM, Ottawa. Countries included in each regions are provided in Table 3 (References).

Long description

The major export markets for key freshwater species is depicted for the years 2014 to 2016 by percentage of total value. 99.6% of Perch exports went to the United States. 95% of Pickerel exports went to the United States, while 5% went to Europe. 79.8% of Whitefish exports went to the United States, while 16% went to Europe, and 4% went to Asia. 68.4% of Smelt exports went to the United States, while 30% went to Asia, and 1.6% went to Europe.

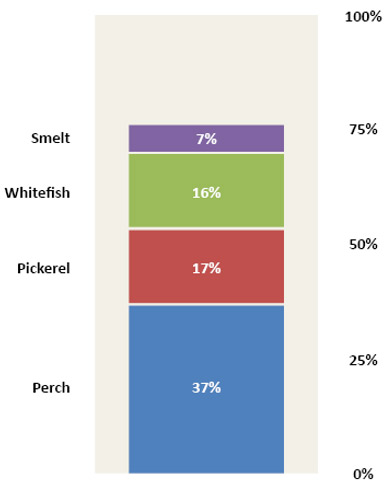

Source: DFO, (2018) EXIM, Ottawa.

Long description

The contribution of key Canadian freshwater species to total export value from 2014 to 2016 are depicted. Perch exports represented of 37% of total value, while Pickerel exports 17%, Whitefish exports represented 16% and Smelt represented 7%. Together, these four species represented 77% of total exports of Canadian freshwater fish for the period.

The majority of exports are sold into U.S. markets (90%). Approximately 6% are sold into European markets. Asian markets account for about 3% of total export based on value.Footnote 13

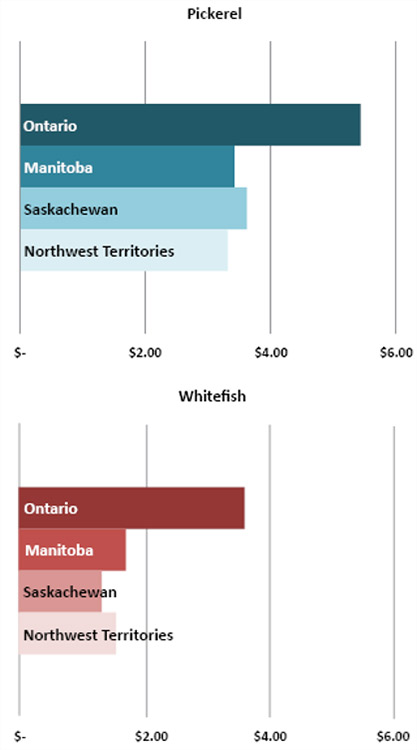

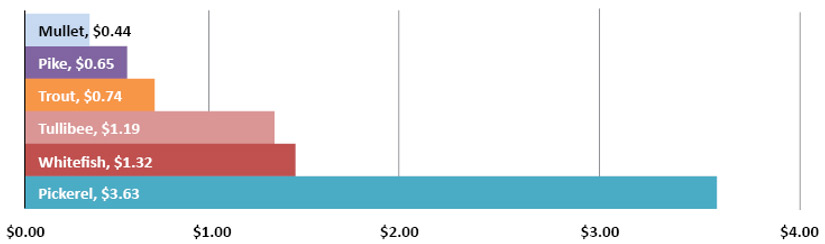

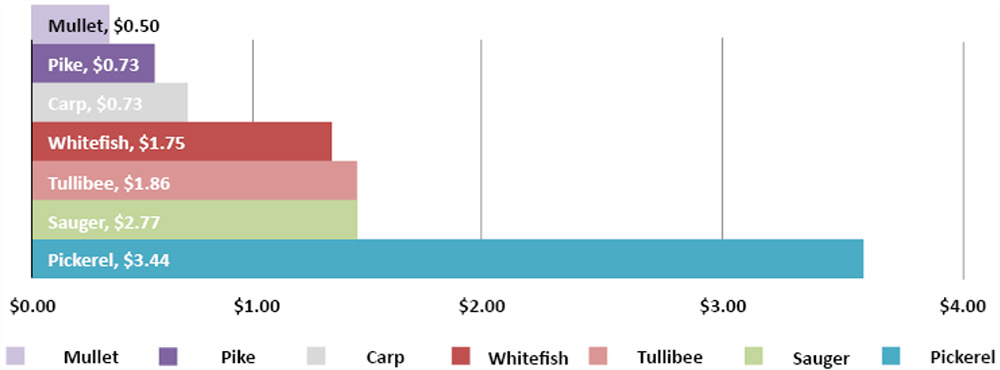

Prices paid to fish harvesters vary by region and reflect factors such as the distance to processing facilities and the market. For example, the average price per kilogram for Whitefish in Saskatchewan is 75% of the Manitoba price, while Pickerel in NWT is 61% of the Ontario price.Footnote 11

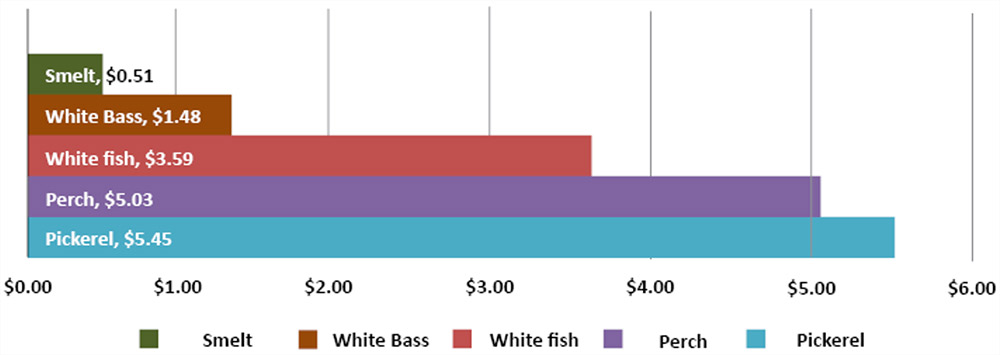

Source: DFO, Freshwater Landings.

Long description

Two charts depicting the average landed price per kilogram by province for Pickerel and Whitefish, respectively, for the years 2014 to 2016, as suggested by division of the total landed weight by total landed value for each province in Canada. In Ontario, the average landed price per kilogram for Pickerel was $5.45, while it was $3.43 in Manitoba, $3.63 in Saskatchewan, and $3.32 in Northwest Territories. The average landed price per kilogram of whitefish was $3.59 in Ontario, $1.75 in Manitoba, $1.32 in Saskatchewan, and $1.59 in Northwest Territories.

3.2.2.2 Management

Constitutional jurisdiction over fisheries in intra-provincial non-tidal waters is shared. Generally speaking, the federal government is responsible for the conservation and protection of all fisheries, including fishing seasons, quotas, size limits and gear requirements. Provincial jurisdiction over non-tidal waters is largely based on their property rights as owners of public lands, including the beds of fish- bearing lakes, rivers and streams. These rights give provinces considerable flexibility to decide on many aspects of fisheries, including conveyances and leases of fisheries, who may fish, what privileges are conferred and what fees must be paid. The federal government has largely delegated intra-provincial fisheries management to provinces. Provinces are responsible for setting quotas, establishing and enforcing regulations, and protecting the health of the fishery.Footnote 14

3.2.2.3 Aquaculture

Aquaculture presents economic growth opportunities in remote and rural communities across Canada, including Indigenous communities. Aquaculture’s linkages with local and regional suppliers of goods and services generate significant indirect economic benefits across a range of industry sectors including manufacturing, retail and wholesale trade, construction, transportation, and business services (Community Profile: Northern Ontario [Trout]).

For example, First Nations in British Columbia are diversifying into fish farming and cultivation, as well as seafood processing and packaging. The Kitasoo/Xai’xais First Nation in the community of Klemtu has formed a joint venture with Marine Harvest Canada to farm and process salmon. In the partnership, the community maintains local ownership of salmon farms and runs their own environmental monitoring program to ensure long-term operational sustainability. An accredited six-month aquaculture training program was also developed and implemented through the partnership, from which local community members have graduated, many of whom still work in the business (Community Profile: Kitasoo/Xai’xais First Nation, BC [Salmon]).

3.3 The Freshwater Fish Marketplace

FFMC competes in a global seafood market. Within this global market, the freshwater fish market comprises less than one percent of total global seafood market. FFMC is currently actively pursuing opportunities in Asia, eastern and western Europe and North America. In 2018, FFMC marketed freshwater products to 14 countries worldwide.Footnote 3

FFMC is well recognized and respected by both customers and competitors in the markets in which it operates. FFMC pursues a general strategy of maximizing customer service, focusing on quality, price and providing a reliable continuous supply to its customers to separate itself from competitors. By doing this, FFMC seeks to advance fisher objectives by providing the markets for harvested fish.

FFMC must work to be adaptive to changing global markets and customer preferences. Changing eating habits, such as an increased interest in consuming healthier foods, play an important role in customer choice.

To maintain a market presence, suppliers must be able to react rapidly to changing market conditions. For FFMC, this may mean having the flexibility to alter its product mix to capitalize on changes in demand. One example of this flexibility would be the ability to switch from fresh to frozen or vice versa in response to changing market demand. FFMC, with its large central processing facility, can be flexible with product form and be cost effective through economies of scale to take advantage of these opportunities in the market.

FFMC must be able to adapt to these demand shifts while being competitive to comparable protein sources. Seafood market consumers have the option of substituting other seafood products for freshwater species if the prices are considered too high. There are also pressures from alternatives other than seafood. Chicken and pork products are also considered desirable protein and, in many cases, can be obtained at lower prices than freshwater fish.

3.3.1 Pickerel/Walleye

FFMC dominates the Pickerel market in the Midwestern U.S., which is the most lucrative market for Pickerel in the world. Coupled with the U.S. dollar exchange value, Pickerel is the most profitable freshwater species sold by FFMC. FFMC has leveraged its ability to supply Pickerel on a continuous basis to both food service and retail sectors of the market to maintain its dominant position. Geographic proximity to the U.S. market has also allowed FFMC to take advantage of shorter-term direct sales opportunities. FFMC has to date successfully competed against other products such as Eastern European Pike which can be as much as 50% less expensive than the FFMC branded product.

Pickerel resource availability is considered a major concern in the future. The decline in the Pickerel resource on Lake Winnipeg has occurred at the same time that the Great Lakes region has experienced growth in the Pickerel resource. One of the advantages that FFMC has is the ability to maintain inventory at levels which permit it to stabilize the market and maximize market returns while maintaining and increasing returns to fishers.

3.3.2 Whitefish

FFMC markets for frozen Whitefish are primarily in Finland and the United States. In Finland, Whitefish is further processed into smoked product which is sold in both the retail and food service sectors. Whitefish in Eastern European markets is sold in whole or steaked form. FFMC is pursuing further product line diversification by processing Whitefish in fillet form to appeal to growing consumer preferences for convenience. Whitefish is also used in North America in the production of gefilte fish for kosher markets. Frozen Whitefish is also sold in retail outlets in Canada.

3.3.3 Northern Pike

FFMC supplies Northern Pike in both minced and portion forms to the French market, concentrated in the Lyon region in southern France. Frozen minced product is used to produce quenelles for retail and food service sectors.

3.3.4 Asian market

The Asian market for freshwater fish is emerging. Freshwater fish is not well recognized in China, but the size of the market and the demands of the population for seafood mean that FFMC needs to pay particular attention to the development of this market. The Chinese market is currently challenging for FFMC as the market is not prepared to pay prices that are high enough to justify diverting product from other markets. FFMC continues to make efforts to develop this market, looking at options for products such as Northern Pike to provide consumer demand opportunities.

3.3.5 Fresh and frozen

FFMC sells its products in both fresh and frozen forms. Historically, FFMC sales of fresh product are made primarily into the Canadian and U.S. markets and have accounted for approximately 25% of total sales. FFMC recognizes opportunities for future growth in this market and is targeting opportunities in the fresh market that would see the percentage of fresh sales rise to greater than 30% of total sales. The sales of product in frozen form both in whole fish and fillets currently make up the other approximately 75% of sales.

3.3.6 Lake Fish Roe

A market segment that has produced considerable value to FFMC in recent years has been the supply of roe. The development of the roe business is an example of an identified economic opportunity that has been developed and nurtured by FFMC over the last decade. The growth of the roe business has had a major impact upon sales of FFMC. What was a decade ago approximately 2% of sales annually has now grown to be in excess of 6% of annual sales. FFMC is currently considered to be the market leader in this business sector, the largest and most trusted supplier of Lake Whitefish and Whitefish caviar to Finland, and the number one supplier for buyers of Tullibee roe in Scandinavia.Footnote 5 The continued development of the markets for Whitefish, Tullibee (herring), Pike and Carp roe, primarily sold in Eastern Europe and the Scandinavian countries, demonstrates FFMC’s continuing efforts to increase returns to fishers and fulfill the mandate provided by the FFMA.

3.3.7 Kosher

FFMC is certified by the Orthodox Union (OU), the world’s largest kosher certification and kosher supervision agency, and considered to be the Gold Standard in its field. This in turn has facilitated access to, and market penetration of, the kosher freshwater business primarily in the United States. Kosher is a term used to denote adherence to standards dictated by Jewish dietary law. The adherence to these standards allows FFMC access to this important segment of the market primarily those markets that require Whitefish, Mullet, Pike and Carp.

The OU certification has been maintained by FFMC for over forty years and is an integral part of accessing and growing markets both among those who adhere to kosher and those who see kosher products as superior in quality because of their strict adherence to processing standards.4 Co-operatives

The Panel, as part of its overall mandate, has been asked to explore and analyze alternative governance and ownership models that support opportunities for broad-based collaboration and co-operation amongst harvesters, including shared decision-making. The Panel considered the opportunities and suitability of various co-operative business models involving stakeholders in the industry. The following summarizes the review of core options, including potential benefits and challenges, and issues that should be considered to support successful implementation and future operational sustainability.

4.1 Overview

Co-operatives (co-ops) are a form of business enterprise with a unique ownership structure; the owners of the enterprise also use the services that the enterprise provides. As an example, the members of fisher co- ops both own the co-op and use the co-op to provide direct services to the fishers such as handling, processing and marketing their fish. In contrast, the owners of the standard business corporation are only investors; they do not use the business’ services. While co-ops may issue investment shares to non-members, such a practice is not common among Canadian co-ops.Footnote 15

Co-ops differ from business corporations in other ways. As the International Co-operative Alliance indicates, a co-op is an “autonomous association of persons united voluntarily to meet their common economic, social, and cultural needs and aspirations through a jointly owned and democratically-controlled enterprise.” This perspective stresses the associative nature of co-ops and the idea that people voluntarily agree to work together to address a variety of goals and objectives in a democratic fashion.

4.2 Co-operative models

Co-ops are differentiated by how their members use the co-op’s services; members of consumer co-ops purchase the services provided by the co-op, while members of producer co-ops sell the product they produce to the co-op for marketing or further processing. Fisher co-ops, found throughout Western and Northern Canada, are examples of producer co-ops.

Larger co-ops, i.e., ones in which scale economies are important in terms of offering high-quality and low-cost service to hundreds and even thousands of members, are typically organized in one of two ways, though there are also some hybrid examples where both are used. In the centralized model, each person using the service is a member of a single co-op. If the members are geographically dispersed, they will typically obtain their services through local facilities that are administered centrally. In the federated model, each member using the service is a member of one of a number of co-ops that are organized and operated locally; the local co-ops, in turn, form a co-operative to give them access to scale economies.

Both structures have advantages and disadvantages. When operated efficiently, centralized co-ops are good at providing standardized services and a common branding and marketing message, while federated co-ops are good at using local information and allowing experimentation. Centralized co-operative structures appeal to members who have a preference for standardization, while federated co-operative structures appeal to members who have a preference for local autonomy.

Finally, the different ownership structure of co-ops means that co-operative governance differs from that of the standard business corporation. As a result of the fact that members are both owners and users, co-ops have often been able to provide additional services or more competitive pricing than would otherwise have been the case. While the provision of additional services or more competitive pricing might lead to decreased profits for a business corporation (and thus not be pursued), co-ops might find such activities worthwhile to undertake since their members will benefit as users.

4.3 Considerations

The following planning and development considerations are noted by the Panel.

Operation

The ability to identify and successfully implement changes to services or pricing depends on good decision making, which in turn requires competent leadership in both the co-op’s management and the board members that oversee operations. The members of the board of directors are typically elected by members, although some co-ops, mostly those that are larger and well established, have appointed independent directors to provide specific expertise (e.g., marketing, finance).

The skills and expertise of the board are important, since the board sets the tone for the co-op and hires and evaluates the manager, or the Chief Executive Officer. In addition to specific business knowledge (e.g., financing, marketing, human resources), board members must be able to operate effectively in groups to sort out good arguments from bad ones, listen to others and incorporate their ideas, build cohesion, and challenge ideas in ways that are productive and not confrontational.

Although many of these skills can be learned, some are specific to particular people. The success of co- ops thus depends both on making board education a key element of governance and on encouraging members with the appropriate skills to participate in the co-op. While creating the organizational culture and dynamic that encourages these two elements is difficult, it can be done; the evidence is the large number of co-ops that have operated very successfully for many years. At the same time, the failures that have occurred – a good example is the Saskatchewan Wheat Pool – indicate that success is not guaranteed and establishing the foundation for good governance is something that must be constantly addressed.

Formation

While co-ops can and do operate successfully once they have been created, starting co-ops is difficult – much more difficult in fact than starting a standard business corporation. The reason for start-up difficulties is that co-ops are associations; they require people to voluntarily agree to work together to address a variety of goals and objectives democratically.

Getting a group of people to voluntarily agree to work together and to accept an ownership and governance structure to which they can agree is difficult. While people may often agree on very high- level goals (e.g., better service), they may disagree on the specifics (e.g., more frequent versus more personalized service). They may also disagree on the particulars of the structure; some members may wish to see the direct election of board members, while others may believe board members should be elected/selected from a set of elected delegates. There are also free rider problems to address, i.e., the inclination that people have to let someone else put in the time, make the monetary investment or patronize the new business while personally doing only the minimum that is required.

Co-operative formation requires the same activities as business corporation formation; business plans must be developed and financing must be secured. Even here, co-ops face unique challenges. For instance, some members may simply not have the capital to invest in the co-op, even though they would be good members were the co-op to be formed. As a result, co-op developers must often find innovative ways to finance the co-op or tailor the business plan to the reduced level of available capital.

Co-operative development

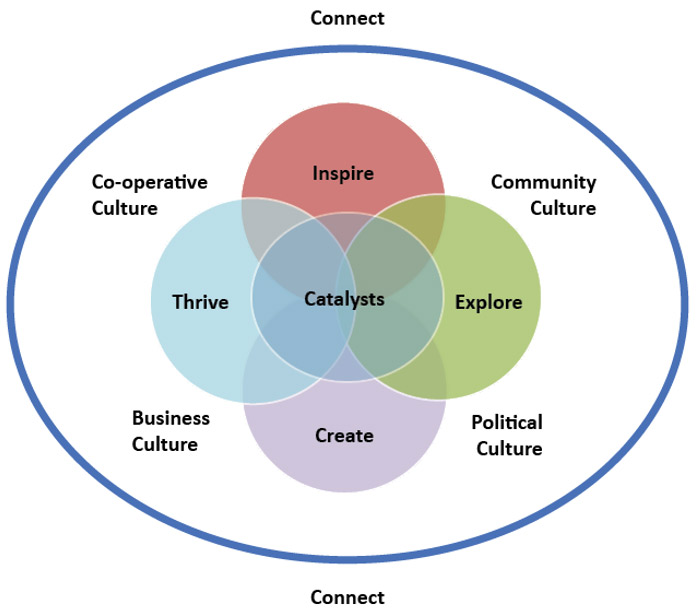

The success of co-ops in both the short and long term depends on co-operative development (co-op development). Co-op development is the process by which co-ops form, grow and thrive. Following the Plunkett Foundation in the United Kingdom (see also Co-operatives First in Western Canada), it is possible to identify four phases to co-operative development:

- inspire: Communities realize they have the potential to address the challenges they face

- explore: Communities explore different ways of addressing their specific challenges

- create: Co-op developers work with the community to help them create a co-operative that they truly own

- thrive: Support is provided to co-ops to allow them to continue to grow and develop

Co-op development takes place within four related but distinct cultures. To be successful, co-op development must ensure that the co-op being developed fits within the general understanding of what being a co-op entails (co-operative culture) and that it fulfills a community need supported by social capacity (community culture). Co-op development must tackle the politics around co-operative business formation (political culture) and it must also ensure the co-op is a credible and viable solution within the larger business environment (business culture). Figure 7 shows the four phases to co-op development and the cultures in which it occurs.

Co-op development is often facilitated by a co-op developer – a person or group of people that help groups work their way through the development phases and navigate the various cultures. Co-op developers act as catalysts in that they assist with the process but do not make the decisions; these must be made by the co-operative members.

4.4 Conclusions

The consequence of the challenges highlighted above is that co-ops are difficult to create. However, once they have been created, they tend to last longer and be more robust than the standard business corporation. The reason for the differential performance is that the co-ops that do form have, on average, been more fully and rigorously analyzed than their business corporation counterparts.

Based on the material that was provided and the community engagement that was undertaken, successful co-op development in the freshwater fishery in western and northern Canada would require attention to all four phases of co-op development and all four cultures. While some communities have created successful local co-ops and must now concentrate on allowing them to thrive, other communities are at the create, inspire and explore stages. All four cultures must also be navigated. In some cases, the political culture – the presence of gatekeepers that oppose this new business form – requires attention before co-op development can occur. In other cases, the community culture (i.e., social capital) requires development. Successful formation may also require a high level of participation from partners connected to the harvester community, including investors and collaborators.

Source: DFO, Freshwater Landings.

Long description

A diagram of the relationships between the four cultures and four phases of co-operative development is depicted. Four circles overlap in the centre of the diagram, with each circle representing a phase in co-operative development. In clockwise order from the top, the circles represent the “Inspire”, “Explore”, “Create”, and “Thrive” phases. A fifth circle, representing “Catalysts” is placed over the overlapping section of these four circles, tying them together. The four cultures are situated around the circles: “Community Culture” is placed near the Inspire and Explore circles; “Political Culture” is placed near the Explore and Create circles; “Business Culture” is place near the Create and Thrive circles; and “Co-operative Culture” is near the Thrive and Inspire circles. A large ring surround the diagram, labelled Connect.

Co-ops are at their core groups of individuals or organizations who voluntarily come together under an ownership and governance structure that meets their needs and better manages their risks. Immediately implementing a co-operative model for commercial fishers would not likely be successful or be sustainable in the longer term.

5 Engagement

5.1 Introduction and approach

The Panel was mandated to explore in greater depth the ideas heard through the recently completed 2017 engagement process on FFMC. The Panel was able to engage with and hear perspectives from a large number of stakeholders during the course of its work.

5.2 2017 Engagement process

The Fisheries and Oceans Canada (DFO) conducted an engagement process in 2017 with stakeholders to better understand the challenges faced by freshwater fishers, the importance of the freshwater industry to stakeholders, and the services offered by FFMC that are most helpful and valued by fishers. Stakeholders included employees of FFMC, commercial freshwater fishers in Manitoba, Saskatchewan and NWT, regional and national Indigenous organizations, representatives of affected fishers’ associations and co-operatives, leaders from remote and northern communities active in the freshwater industry, and provincial and territorial governments.Footnote 16

Over 300 people participated at in-person sessions held in 19 communities across Manitoba, Saskatchewan and NWT. Approximately 40 online surveys were also submitted.Footnote 16

5.2.1 2017 Engagement key findings

The engagement process highlighted the views and concerns of fishers and underscored their concerns about the potential to be adversely affected by these changes, especially in northern and remote communities and NWT. DFO stated that it would support the continuation of services provided by FFMC to all fishers in the near-term while a long-term way forward is determined, and that it was committed to working with fishers and other key stakeholders on the future of FFMC.

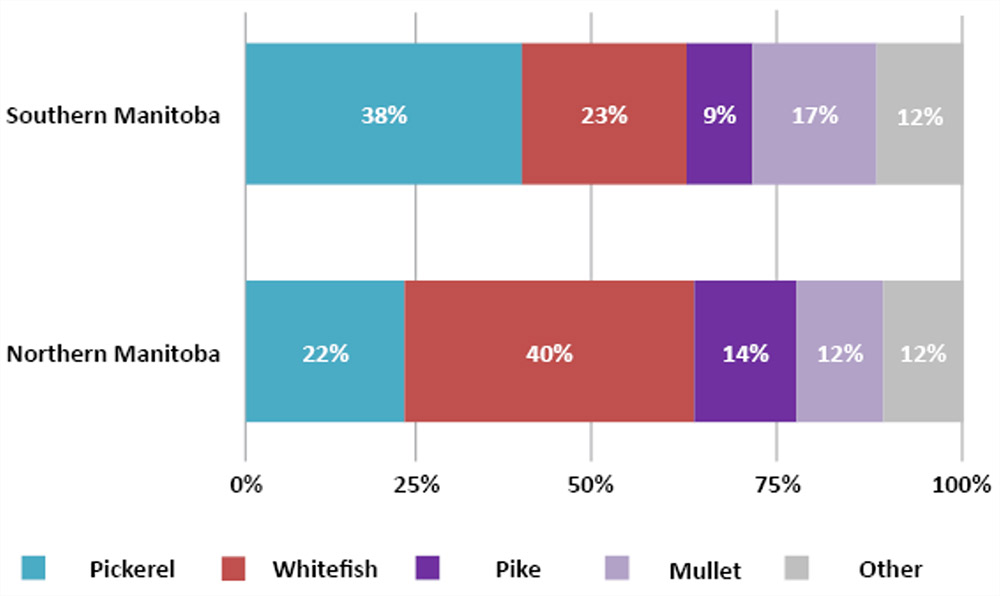

Concerns from across northern, remote and Indigenous communities were markedly consistent, particularly in Saskatchewan and Manitoba. Participants from the sessions in NWT diverged in their views on marketing and the future of FFMC. Another contrast in findings was evident when examining the results from northern and southern communities; those in northern communities were generally more supportive of FFMC, while those in southern communities were more receptive to the prospects of an open market model.Footnote 17

The following findings were drawn from these interactions:

- FFMC is recognized as producing high quality products and fishers are reluctant to see the disappearance of the organization

- Fishers spoke of unique challenges facing the industry, including unsustainable freight costs, distant processing capabilities, inadequate subsidies and difficulties in attracting and retaining younger workers

- fishers claim the price they receive for their fish has remained stagnant and not kept pace with rising costs and inflation pressures

- fishers noted the need for fishers to be included in the governance structure at FFMC, including increased transparency and a more “bottom up” approach to decision making, allowing FFMC to better represent fishers’ interests

- calls for expansion of FFMC service offerings, including benefits (medical and pension benefits) as a way to entice younger fishers to the industry and enhance economic benefits to their communities

- northern and remote communities rely on investments from FFMC or other levels of government, including the improvement of fishing infrastructure or transportation subsidies. These services are important to the sustainability and competitiveness of these communities

- Manitoba fishers in northern and remote communities expressed a need for additional support to help them successfully participate in an open market

- indigenous and northern communities are apprehensive about the adverse economic consequences that an open market may have on their communities and way of life

- fishers in Saskatchewan and Manitoba have concerns about environmental degradation and its effect on their fishing grounds

- fishers who participated in the engagement showed little support for the dissolution or privatization of FFMC:

- fishers felt that privatization would not necessarily yield better prices for fishers as private entities are more interested in their bottom line than providing fishers with a larger share of profits

- fishers noted support for the continuation of FFMC in some capacity, perhaps under an alternative business model that could address many of their primary concerns including: profit sharing, ownership over company assets, and greater control over strategic direction and governance

- an alternative business model would also help to alleviate some of the mistrust fishers currently feel towards FFMC

5.3 Panel engagement activities

Consistent with its mandate, the Panel completed engagement activities that focused on exploring in greater depth the key conclusions from the 2017 engagement process and hearing from stakeholders their perspectives on alternative governance and ownership models that might support opportunities for collaboration and co-operation among harvesters. The Panel was also interested in hearing from stakeholders where and what role they felt they could have in the implementation of these models.

The Panel identified stakeholders within each of the active jurisdictions that FFMC currently operates within or remains a signatory to the FFMA. These stakeholders included FFMC senior staff, active commercial fisher organization representatives, regional Indigenous leadership, provincial and territorial government representatives, national fishery associations, and other stakeholders with a keen interest in the future of FFMC.

Stakeholders were contacted directly to introduce the Panel, describe the Panel’s mandate and objectives, and inquire if there was an interest in meeting with the Panel. The focused in-person meeting process provided the Panel with an opportunity to engage and ask questions of each stakeholder to ensure clarity, accuracy and to focus the discussion on elements of interest to the Panel.

Invitations were sent to stakeholder groups prior to the meetings in each location. These letters of invitation provided additional information that described the Panel and the Panel’s areas of focus and interest; they also included a series of questions intended to help guide the discussion with specific stakeholders. Specifically, the Panel sought feedback from stakeholders on

- what governance and ownership structures should be considered to support the long-term viability of the freshwater fishing industry and provide opportunities for all fish harvesters

- what were the strengths and weaknesses of these structures in meeting these objectives

- what role do they feel they could contribute in the transformation process

A dedicated e-mail address was set up to receive input, questions, and submissions to the Panel. Stakeholders were encouraged to provide written submissions to the Panel, particularly if they were unable to meet or had additional information and perspectives they wanted to share. A copy of the engagement letter is included in Appendix C.

The Panel had the opportunity to meet and discuss with many stakeholders throughout this process. The Panel’s engagement activities are summarized in Table 1.

5.4 What we heard

Many of the comments that the Panel received reinforced messages reflected in the engagement process in 2017. The opportunity to meet with some of the earlier participants and explore how a transition process could be accomplished was an area pursued during the 2018-19 engagement process. Outcomes from these discussions are reflected in the observations section of this report.

| Date/ location | Stakeholder group |

|---|---|

| September 12-13, 2018 Ottawa |

DFO staff Co-operatives and Mutuals Canada |

| September 23, 2018 Winnipeg |

Freshwater Fish Marketing Corporation |

| October 28-29, 2018 Hay River Yellowknife |

NWT Fisherman’s Federation NWT Métis Nation Kátł’odeeche First Nation Dene Nation Government of Northwest Territories Morin Fisheries |

| November 8-9, 2018 Winnipeg |

National Indigenous Fisheries Institute Assembly of Manitoba Chiefs Ni Akinde (National Indigenous Economic Consortium) Manitoba Metis Federation |

| November 22, 2018 Saskatoon |

Prince Albert Grand Council MétisNation–Saskatchewan Federation of Sovereign Indigenous Nations Saskatchewan Co-operative Fisheries Limited Ile-a-la-Crosse Fish Company Meadow Lake Tribal Council |

| January 4, 2019 Teleconference |

Government of Alberta |

| January 11, 2019 Teleconference |

Government of Saskatchewan |

| January 15-16, 2019 Winnipeg Thompson |

Government of Manitoba Manitoba Keewatinowi Okimakanak Fisher River Cree Nation Norway House Fishermen’s Co-op Commercial Fishermen's Association of South Indian Lake Northern Association of Community Councils Leaf Rapids Nelson House Fishermen’s Association Moose Lake Fishermen’s Association Easterville Wabowden Split Lake Pukatawagan Fishermen's Association Granville Lake Fishermen’s Association |

| March 21, 2019 Winnipeg |

Assembly of First Nations, National Fisheries Committee |

6 Observations

The Panel received exceptionally valuable information during engagement activities with stakeholders. This information, along with the review of supporting documentation about the inland fishery including materials provided by FFMC and DFO, and discussion among panel members contributed to the Panel’s understanding of the diverse stakeholder perspectives and the drivers of change in the current environment.

The Panel concluded there are many diverse stakeholder interests in the inland fishery served by FFMC. These interests can be summarized as follows:

- fisher interests include:

- desire for better financial returns, including expanded markets and the addition of more value in current markets

- sustainable fisheries and preservation of fish stocks

- improved understanding of the operations of FFMC

- direct participation in FFMC decisions that directly affect them

- an ongoing role for FFMC into the future

- opportunities for youth and the next generation

- government interests include:

- maintaining administrative roles within their respective jurisdictions of responsibility

- supporting the sustainability of the resource and long-term viability of the inland fishery

- balancing the needs and interests of the recreational/sport fishery with those of the inland fishery

- recognizing the positive role FFMC has today and can have in the future, particularly in northern and remote communities

- supporting the long-term economic viability of FFMC, including wanting to ensure management and directors have skills that complement the needs of the organization

The Panel noted that each jurisdiction (federal, provincial, territorial) operates largely independently and that the level of coordination among the government groups is not currently at a level required to move forward successfully.

- northern and remote community interests include:

- recognizing that these communities will be most adversely affected by an open market system

- ensuring the considerable non-monetary value commercial fisheries have to communities is sustained

- FFMC interests include:

- maintaining the ability and capacity to buy, process and market high quality freshwater fish on behalf of over 1,600 fishers in Manitoba, Saskatchewan and NWT

- addressing the issues associated with management, increased competition, and fisher concerns

- non-government organizations have interests including:

- concerns that the current structure of FFMC no longer provides the greatest value to fishers and that the model needs to change to be sustainable

- promoting consistency and standards across fisheries management and Indigenous peoples

- working directly with communities, regional organizations and government agencies to maximize the potential of fisheries to benefit Indigenous peoples and communities across Canada

- acquiring a portion or all of the existing FFMC operations and transforming the new entity to align with different organizational objectives

- private processor interests include:

- focusing on individual business plan models but recognizing that they are linked to the economic viability of FFMC

- maintaining supply for their customer base (for private processors operating outside FFMC’s geographic area)

- Regional value adding groups, such a regional processing co-operatives, are interested in:

- supporting sustainable economic opportunities for local populations, regional value- adding, and contributing to the long-term viability of regional commercial fisheries

- their contribution to preservation of cultural lifestyle and heritage as notable non- monetary benefits

The diversity of interests underscores that within the current environment there is no obvious consensus or alignment of perspectives and interests among these groups.

The Panel also noted various influencing drivers affecting the inland fishery within the areas served by FFMC:

- biomass: Fishers throughout the study area shared concerns about unique resource management practices in each jurisdiction and concerns about the overall sustainability of resource:

- a sustainable resource is the foundation of any future organizational or ownership structure. Sustainable resources provide the assurance that resources will be there to support future generations of fishers

- fishers raised concerns about how pollution, climate change and other human-made disturbances will affect the fishery. The uncertainty with the scale and scope of this impact, as well as the fishers’ ability to adapt to these changes, was raised in each region

- fishers recognize the role regulatory agencies play in the management of the resource. Fishers, however, feel they are not kept adequately informed, particularly of decisions that are made on quotas or resource management, perceiving that decisions do not involve them or are made without consideration of their perspectives

- fishers expressed concern in some jurisdictions about the lack of resources made available to carry out the research work needed to determine biomass levels. This has contributed to a lack of confidence in the information that is shared and a level of distrust with regulatory agency reports and guidance

- engagement feedback has identified the value of more research and scientific work in improving the understanding of the species populations. Having fishers directly involved in this process would be beneficial

- better coordination is required between federal and provincial regulatory agencies to ensure resources are present for future generations

- marketplace: FFMC does not have a monopoly in the market place, although it does have some pricing influence in some markets:

- although it has some ability to adapt to market changes, FFMC does not have any ability to define either buyer or consumer preferences

- the effort, time and cost required to develop and maintain effective markets is considerable

- competitive environment: The implications of open market competition in western and northern Canada is not fully known at this time. Competition is expected to benefit fishers harvesting desirable species in favourable locations, and to negatively affect fishers harvesting less desirable species in less favourable locations

- fisher sustainability: The long-term sustainability of the inland fishery is closely linked to the sustainability of the individual fish harvester. Various factors are challenging this:

- the average age of fishers is increasing

- pricing and revenues are stagnant compared to increasing operating costs

- youth are being presented with more diverse employment options

- opportunities to improve food security through locally sourced food and the increased recognition of the social importance of fishing to remote and northern communities are both viewed as positive steps in supporting fisher sustainability

- human capital: The ability to adapt to change. The Panel noted at numerous times during the engagement process of the challenges commercial fishers have had providing appropriate leadership, management, and accountability within their own organizations. In the competitive and open market environment, these skills are essential for fishers and fisher organizations to be successful.

The Panel notes that these drivers contribute to increased uncertainty within the inland fishery. FFMC has noted that this uncertainty has already affected supply availability and the marketing of fish products. This uncertainty is likely to persist and will continue to disrupt fishers, processors, and marketers for the foreseeable future unless change is forthcoming. The single market desk model under which FFMC historically operated is not viable in today’s open market environment.

Along with the acknowledgement of the need for change in a timely manner is the recognition that change will affect over 1,600 fishers and the communities to which they are connected. Stakeholders participating in the engagement process, including but not limited to fishers, spoke of a need to be sensitive to this point. They also spoke of the need for gradualism and time to allow change to occur, as well as the need for support throughout the change processes to ensure people most affected by the change are supported. The Panel noted through engagement the existence of key potential partners interested in supporting the development of positive change, and in participating in a future transformed FFMC organization.7 Recommendations

7.1 Introduction

The Panel is pleased to bring forward a set of recommendations on the future of FFMC and the inland fishery in western Canada. The recommendations address the mandate objectives provided by the Minister, take into account the current economic and biophysical environment, recognize the factors driving change in the fishery, address the interests and issues identified during the Panel’s interactions with stakeholders, and consider supporting documentation and discussion among panel members.

The Panel’s recommendations underline the need for change. Manitoba and Saskatchewan’s withdrawal from the FFMA in recent years, increasing concerns about the biomass and sustainability of the fish resource, and changes in the marketplace, including consumer preferences, all indicate that the current structure of the inland fishery is no longer suitable to meet the needs of those with a stake in the fishery.

In developing recommendations, the Panel operated with two core considerations. First, the Panel does not consider the maintenance of the existing system and business model to be sustainable. The Panel anticipates that new firms and economic organizations will continue to enter the marketplace in which FFMC currently operates to pursue opportunities in the open market environment. This perspective is supported by the Panel’s interactions with FFMC representatives and most stakeholders. Second, the Panel did not consider the dissolution of FFMC. Although stakeholders provided many examples of issues and concerns they would like to see resolved, they overwhelmingly support the concept of a fish processing and marketing function to support the efforts of fishers.

The Panel’s recommendations recognize the diversity of interests among the current stakeholders and that there is no obvious consensus or alignment of perspectives among groups (see Section 6).

The Panel thus concluded that any attempt to impose a Panel-constructed structure on the fishery would be unsuccessful.

However, the Panel does believe that it is possible for the current stakeholders to reach agreement on a structure. The Panel also believes that the structure that is most likely to result in agreement involves the creation of a formal association of fish producers (for example, a federated co-operative) that can accommodate different regional perspectives and interests while achieving the required economies of scale with processing and marketing to external markets. More details on this business federation are provided below.

The Panel’s recommendations are designed to provide a highly structured process within which the stakeholders can resolve their differences and reach a decision they all support. The Panel’s recommendations are also designed to develop outcomes that support meaningful opportunities for collaboration and co-operation among harvesters, integrate the needs of Indigenous fishers and their communities, and support self-determination. To this end, the Panel recognizes the process will require independent and neutral support from the outset.

The Panel’s recommendations and actions are guided by the following principles:

- immediately implement practical actions to reduce uncertainty.

- provide a timeline and schedule for the implementation of the transformative process

- provide resources dedicated to supporting the expected transformation process

- provide time in the transformation process so that adversely affected parties have reasonable time to adjust.

- stakeholders who face the greatest impact of an open market system are also the groups that have the least ability to adjust

- groups located in northern and remote communities have greater socio-economic challenges because of their geographical location, have higher input costs and higher freight costs, and harvest generally less valuable species in lower volumes

- stakeholders who face the greatest impact of an open market system are also the groups that have the least ability to adjust

- recognize the need for capacity building

- fishers and communities, particularly those potentially most adversely affected by these changes, need to be adequately prepared to operate in the open market system. While many of the issues they face cannot be changed, time and resources can enhance the resilience of local populations and fishers and their ability to adapt to these changes

- increased capacity and support that develops skills and awareness of the business will help in whatever transformation outcome occurs

- improve information sharing and communication between fishers and FFMC and among fishers

- required if stakeholders are to understand and appreciate the changes and progress being made during the transformation process

- will reduce uncertainty and speculation among harvesters and other stakeholders

- provide time for effective steps to be taken to address biomass concerns.

- dustainable biomass management and participation of stakeholders is an important step in the development of a sustainable inland fishery

- governments involved in resource management should actively listen to stakeholders directly involved in the harvesting of the resource

- participation in the monitoring of aquatic resources by harvesters supports the ability of regional communities to promote self-determination and the stewardship of the natural resources they rely on

- provide time for commercial fishers and other regional stakeholders to meaningfully explore and determine what role they collectively want to have in the future process

- for most fishers, the future of the inland fishery in the area served by FFMC will be defined by the extent to which fishers are able to collaboratively share risks and opportunities on a larger scale than has been the experience to date

- provide time for federal, provincial and territorial governments and agencies to determine what specific roles they will have in supporting this transition within their jurisdictional regions

- provide time to appropriately define an effective role for FFMC in the changing environment.

- FFMC and participating fishers need to assess the implications of any proposed changes to the viability of FFMC. It has only been one year since Manitoba has moved to an open market system. The implications of the increased competitive environment are only now beginning to be experienced by FFMC and commercial fishers

- several regional processing plants are being established. Their viability, both individually and collectively, depends on their relationship with each other and with FFMC

- the Strategy for Revitalizing the Great Slave Lake Commercial Fishery has identified an ongoing role for FFMC as a buyer of last resort when fish products cannot be successfully marketed by NWT

- other fishers or fisher organizations may similarly consider FFMC as a willing buyer of last resort. The viability of such a business model and its impact on various stakeholders has not been established

It is important to stress that the Panel’s recommendations identify a process that involves all stakeholders, including governments. Encouraging collaboration and co-operation among stakeholders will be required to move forward under any alternative. Approximately 1,600 fishers participate in the inland fishery served by FFMC. These individuals and the communities to which they are connected need to be considered in developing plans for this important industry.

The following recommendations describes a three-year process that involves immediate changes to FFMC in Year 1, human and organizational capacity development in Year 2 and completion of a path forward in Year 3.

7.2 Year 1: Changes to the Freshwater Fish Marketing Corporation