Audit of Revenue Management

Project 2019-6B310

Date:June 2021

On this page

- Introduction

- Audit Findings

- Appendix A: Lines of enquiry and audit criteria

- Appendix B: Management action plans

Introduction

Context

The Department of Fisheries and Oceans (DFO or Department) collects revenue from a variety of programs, products, and services ranging from fisheries management licensing (commercial and recreational) to marine navigation to dredging and icebreaking. Revenues collected from these programs, products and services is categorized into two groups: non-respendable and respendable. Non-respendable revenues are earned on behalf of the Government of Canada and are to be deposited into the Consolidated Revenue Fund. These non-respendable revenues are generated by DFO primarily through the fisheries management licensing revenue stream. Respendable revenues are revenues for which DFO has specific authority from Parliament to respend and are treated as recoverable costs. These respendable revenues are generated primarily though marine navigation, dredging and icebreaking services provided by the Canadian Coast Guard (Coast Guard).

While revenues are small relative to the Department’s overall annual budget, revenues are increasing. Total revenue increased by 14% from fiscal year 2016-2017 to fiscal year 2019-2020Footnote 1. For fiscal year 2019-2020, the Department collected approximately $93M in revenues from a variety of programs, products and services. Non-respendable revenues accounted for approximately $44M, of which 95% was generated from fisheries management licensing fees. Respendable revenues accounted for approximately $49M, of which 68% was generated from Marine Navigation Services fees, 16% from Dredging Services fees and 12% from Icebreaking Services fees.

The Department’s revenue management is subject to several governing authorities. The Service Fees Act enables DFO to collect revenues from its programs, products and services. In conjunction with related acts such as the Oceans Act and the Fisheries Act, DFO must also comply with the Financial Administration Act, TB Policy on Financial Management, as well as guidance provided in the TB Directive on Charging and Special Financial Authorities and the TB Directive on Public Money and Receivables.

The Department has put in place a number of policies that pertain to revenue management, including the Policy on Accounts Receivable, Revenues and Deferred Revenues, and the periodic Service Fee Review Framework. These policies designate the CFO as the lead departmental executive responsible for ensuring that a framework is in place for the on-going monitoring of accounts receivable, revenue and deferred revenue. The CFO is also responsible for ensuring that a departmental plan and framework to periodically review activities for which fees are charged is established and implemented. In addition, the CFO provides the necessary guidance on and support for the review of all departmental fees to ensure proper authorities are in place, and to ensure compliance with all related legislation. The Accounting Operations directorate within the CFO Sector is the centralized function that supports the CFO in the collection of fee revenues from the Canadian Coast Guard programs and recording them in Abacus, the department’s former financial system that was replaced by SAP in 2021. DFO programs also collect some payments such as leases, point of sale transactions and licensing fees through the National Online Licensing System (NOLS), and report them to Accounting Operations to be entered into and accounted for in Abacus.

The CFO Sector is in the process of strengthening and communicating roles and responsibilities within DFO and Coast Guard for revenue lifecycle to ensure alignment and compliance with Service Fees Act requirements. In 2019-2020, the CFO Sector conducted internal consultations on the need to have a revenue management team at the departmental level. As a result of these consultations, a Centre for Excellence for Revenue within the CFO Sector was created to provide guidance, direction, stewardship and strategic coordination services to departmental programs in the development of revenue streams and the maintenance of service fees to ensure horizontal coordination. While the CFO Sector is primarily responsible for departmental revenue management, the regions and programs also carry out some revenue and fee collection activities.

This audit was conducted in accordance with the Department’s Risk-Based Audit Plan 2019–2021. Revenue management was identified for audit due to the decentralized nature of the Department, the inherent risks related to complex revenue streams across regional offices and National Headquarters (NHQ), and the Department’s changing regulatory landscape due to the introduction of the Service Fees Act, which replaced the User Fees Act and introduced a number of changes, some of which came into effect on April 1, 2021. The audit was completed as the Department was replacing Abacus, its legacy financial system, with SAP in April 2021.

Why this audit is important

An audit of revenue management is important because it covers a number of inherent risks:

- changes to service fee requirements based on the Service Fee Act

- the extent to which the Department can collect on its resendable revenues and fees directly affects CCG’s ability to ensure the continued delivery of services and funds its operations

- at the departmental level, it requires the effective governance and implementation of internal controls to effectively collect and process revenue transactions

Audit objective

The objective of this audit was to determine whether governance and internal controls for the collection and processing of revenues are effective.

Audit scope and approach

The scope of the audit covered specific aspects of DFO’s governance over the reporting and monitoring practices for fees and other revenues, authorities, responsibilities and accountabilities, as well as the assessment of internal controls over the collection and processing of fees. As part of the planning phase for the audit, a risk assessment was conducted to focus the audit criteria on the highest risk areas to the Department. These were related to: governance (specifically authorities, responsibilities and accountabilities; performance measures; monitoring); and internal controls (specifically over the collection and processing of fees).

The audit did not examine the elements below due to factors such as residual risk, audit readiness, and overall benefit realization to the Department for the audit work to be performed:

- governance elements with respect to revenue policies and directives, as well as capacity management related to human resources and skills

- department-wide risk management processes including the risk of fraud

- internal controls and processes with respect to fee determination, forecasting, and IT systems and technology

The audit covered the period from April 2019 to November 2020. Transaction testing spanned the period from April 1, 2019 to March 31, 2020. The audit also considered information outside of this period to perform an analysis of the aging receivables and an assessment of readiness for remissions. The new financial system (SAP), which was implemented in April 2021, was not in place during the time this audit was completed. As a result, the source data used to perform the audit work was from the old financial system (Abacus). See Appendix A for Lines of Enquiry and Audit Criteria.

Audit work was carried out through:

- use of videoconferencing technology to conduct interviews with key departmental officials

- review of applicable legislation and regulations

- review of Treasury Board and DFO policies and directives on revenue management

- review of departmental procedures and guidelines, including standard operating procedures

- review and verification of delegations of authority and proper segregation of duties

- walkthroughs and process mapping of revenue and asset handling procedures

- transaction testing of revenue processing in regions and National Headquarters

- data analysis on revenue collection and processing information

Conclusion

Overall, the audit concluded that Fisheries and Oceans Canada has established governance processes and internal controls for the collection and processing of revenues. However, opportunities exist to further improve their effectiveness. Specifically, the audit found the following:

- governance committees are established and their mandates documented. However, governance practices are not updated and roles and responsibilities could be clarified to effectively support departmental revenue management activities

- a collection process is in place but revenues are not always collected in a timely manner

- documentation and approval requirements for processing revenue transactions could be further clarified and communicated to programs and regions

Statement of conformance

This audit was conducted in conformance with the International Standards for the Professional Practice of Internal Auditing as supported by the results of the Quality Assurance and Improvement Program of Fisheries and Ocean Canada’s Internal Audit Directorate.

Audit findings

Governance

Effective governance serves as a control to reduce risks that may impede the achievement of departmental mandates and objectives with respect to revenue management.

Governance structures are in place. However, roles and responsibilities related to revenue management are not fully defined and communicated

The audit examined whether authorities, responsibilities and accountabilities related to revenue management were clearly defined and communicated. Overall, the audit found that departmental governance committees have defined and documented mandates with relation to revenue management, and that CFO Sector has documented high-level roles and responsibilities as required by the Service Fees Act. However, the purpose and scope of how departmental governance sub-committees support revenue management oversight and the roles and responsibilities related to revenue lifecycle are not clearly defined and communicated.

Committees

The audit found that senior departmental committees are established to govern revenue management activities. The Departmental Management Committee (DMC) is responsible for approving reporting documents, including the Departmental Results Report (DRR), Departmental Plan (DP), and Quarterly Financial Statements (QFS) with revenue related financial information.

DMC is supported by several sub-committees, two of them that cover financial management matters, namely the Financial and Investment Management Committee (FIMC) and the Programs and Operations Committee (POC). FIMC is responsible for providing advice and recommendations on all department level matters related to financial and asset management, whereas POC is responsible for providing advice and direction on matters related to programs and operations within DFO. There is a lack of distinctionof roles and responsibilities between FIMC and POC with respect to the decision-making or advisory authorities and accountabilities related to revenue management. Clarity in purpose and scope of FIMC and POC would allow for enhanced oversight roles and responsibilities, and for effective challenge to take place on matters such as review of revenue frameworks, roles and responsibilities, and fee reports before seeking DMC approval.

Through the review of committee records of discussion (RoDs) and agenda items, the audit found that, revenue and cost recovery related items were presented at the committee and sub-committee levels. However, contrary to the current DMC Terms of Reference, departmental reports such as the DRR, DP and QFS etc. to DMC or the sub-committees were not submitted. Consequently, this limited the opportunity of a challenge function on these reports. The Financial Situation Report that provides information on voted net revenues and cost recovery was the only reporting document presented to both FIMC and DMC. Presenting departmental reports to committees would strengthen a culture of management accountability around financial reporting practices.

Lifecycle roles and responsibilities

The audit found that the CFO Sector has documented high-level revenue management roles and responsibilities to align with the Service Fees Act. A draft Periodic Service Fee Review - General Framework (Framework) was approved by the CFO in October 2019 and subsequently presented to FIMC in November 2019. The Framework outlines high-level roles and responsibilities for performing fee reviews and reporting on conformance with the Service Fees Act. The CFO Sector has also prepared one-pagers that define and document, at a very high level, the revenue management roles and responsibilities for the CFO Sector.

However, the audit found, through interviews with employees in NHQ and across regions and programs as well as review of policies and frameworks, that more detailed roles and responsibilities for revenue lifecycle should be communicated to DFO and Coast Guard stakeholders to help ensure they are clearly understood.

Clearly defined and communicated revenue lifecycle roles and responsibilities would allow stakeholders to execute their part of the revenue management lifecycle, thereby resulting in consistency across programs and regions, as well as cooperation and integration of revenue management activities.

Performance measures are established and linked to planned results. However, the Department has not yet implemented all SFA reporting requirements

The audit examined whether performance measures are established and linked to planned results. Overall, the audit found that service standards are in place and performance towards these is monitored and reported in the annual DFO Service Fees Report. However,the Department has not yet implemented all reporting requirements of the Service Fees Act and lacks some capability to track payments and communicate annual fee adjustments.

Reporting

Section 20 of the Service Fees Act requires the Department to report, in each fiscal year, the revenue received from the service fees and the degree of compliance with any performance standards established with respect to those fees. In terms of reporting, the audit found that the Department is currently not meeting all Section 20 requirements of the Service Fees Act as it is not reporting on revenue collected for all individual types of fees. Fisheries and Harbour Management revenue figures are not available at the individual fee level and the Department’s financial system does not capture revenue by fish species. A review of the DFO Service Fee Report for Fiscal Year 2019-2020 indicated reporting on only 36 of 484 types of fee. However, this is an improvement over the previous fiscal year where only 3 of 471 fees were reported.

Section 20 of the Service Fees Act also requires that departments report on the degree of compliance with any performance standards established in respect of those fees. The audit found that in reporting on performance against service standards, regions provide an estimate of the service level achieved at year-end, but no detailed supporting documentation, and no verification is completed by the Fisheries and Harbour Management NHQ team or the CFO Sector before reporting in the Service Fee Report.

The reporting on revenues for all the individual fees would allow the department to comply with mandatory regulatory requirements. A formal review process and enhanced system capabilities would allow the department to ensure that service levels achieved are tracked and reported accurately in the Service Fee Report.

Remissions

Section 7 of the Service Fees Act, which took effect on April 1, 2021, requires departments to remit back a portion of a service fee paid if a service standard was not met. The audit found that the Policy on Remissions was approved by the Deputy Minister and then published on the Department’s website on March 31, 2021. The DFO Policy on Remissions outlines the type of fees that are subject to remissions; the service standards for each fee; and the remission calculation for not meeting the service standard.

However, the Fisheries and Harbour Management Sector lacks the capability to track payments through an automated process at an individual fee level to remit fees and report on performance against service standards. Responses from the regions indicated that they are unable to track individual fee payers for service standards in their regional systems.

Fee review and adjustments

Section 17 of the Service Fees Act requires the Department to increase fees on an annual basis to adjust for inflation using the prior year’s Consumer Price Index. As such, the annual fee adjustments are to be communicated to the regions by the CFO Sector. The Department is required to also establish and implement a departmental plan to periodically review activities for which fees are charged.

The audit found that there is no formal process in place to communicate annual fee adjustments to the regions for Fisheries and Harbour Management licensing services and to effectively monitor implementation of the fee schedules in the National Online Licensing System (NOLS). Interviews with regional officials indicated that for fiscal year 2019-2020, there was insufficient time and limited direction provided to roll out the fee increases. This resulted in clients being charged incorrectly due to system programming errors and fees not uploading properly.

The Service Fee Review Framework requires periodic service fee reviews to be completed in part to ensure performance standards are met. The Framework also requires review summaries and recommendations for each fee category to be presented at DMC on an annual basis, and for bi-annual reviews of the Service Fee Review Framework to be presented to FIMC and PIC for approval. The audit found that at the time of the review, the process and procedures to perform these reviews and to report on the results to governance committees had not been documented and initiated.

Monitoring processes to ensure accuracy and completeness of revenue-related financial information could be strengthened

The audit examined whether monitoring is performed to ensure the accuracy and completeness of revenue-related financial information. The audit found that revenue information in program systems is not periodically verified and reconciled with the departmental financial system to identify and address revenue errors and issues in a timely manner. A consistent and periodic process to review revenue related financial information with clearly defined roles and responsibilities would allow for revenue coding errors to be identified and addressed in timely manner, thereby, mitigating the risk of inaccurate reporting.

The audit found that reconciliations are performed by Accounting Operations on a periodic basis to ensure that all revenue is accounted for. Year-end procedures for processing and recording revenues are established to ensure that revenue processed are accurately reported for the period they were earned.

To ensure that only revenue received (cash basis accounting) is attributed to respendable revenue as required by the Financial Administration Act, respendable revenue was only recognized in Abacus, the financial system, when payments were received and matched to an invoice. However, there are no processes in place to verify that the coding on the cashbook is accurate and that revenues are correctly entered into the financial system. Cashbooks are completed by the programs and sent to the Accounting Operations to account for payments received by the Department. The cashbooks are important as they contain coding information that allows the Accounting Operations to record the payments in the financial system.

CFO sector representatives stated that regions and programs are expected to verify the accuracy and completeness of revenue-related information including the coding information used by the Accounting Operations to record transactions in Abacus. However, there is no process to verify accuracy of coding information, and responses from regions and programs indicated lack of awareness and understanding of their roles and responsibilities to verify this information. It is important to accurately code transactions before they are recorded in Abacus to allow for revenue collected for each individual fee to be accurately reported in the annual Service Fee Report.

In addition, there is no process for the periodic reconciliation between the program systems and Abacus other than at year end by Centre of Excellence for Revenue when reporting fees in the Service Fee Report. The verification of the coding information and periodic reconciliation between the program system and the financial system, would allow for coding errors and discrepancies to be identified and resolved in a timely manner, prior to reporting the fee information in Service Fee Report.

The above challenges are attributed to a misunderstanding of roles and responsibilities, as previously covered in the previous section on roles and responsibilities. Once the lifecycle roles and responsibilities are more clearly defined and communicated, it may contribute to their greater understanding and allow for more consistent verification and monitoring of revenue related financial information.

Recommendation 1: The Assistant Deputy Minister and Chief Financial Officer should update governance to strengthen departmental revenue management activities.

Internal controls

Guidance for the management of accounts receivable is in place. However, revenues are not collected in a timely manner in compliance with legislation and policies

The audit examined whether revenues are collected in a timely manner in compliance with legislation and policies. Overall, the audit found that policies and directives exist for the management of accounts receivable, and these align with TB policies and directives. However, a process is not in place that pursues timely collection of receivables. While the write-off process is documented and approved, the write-offs are not performed on a timely basis. Finally, the audit did not find performance metrics in place to support the management of receivables and write-offs.

Collection of receivables

The TB Policy on Financial Management expects Departments to have effective internal controls over financial management, and standardized and efficient financial management practices in place. Section 4.3.5 of the TB Directive on Public Money and Receivables states that the CFO or the senior departmental managers designated by the deputy head are responsible for taking timely and cost-effective collection actions to pursue receivables, such as the use of a set-off. Timeliness of collection actions is critical to maximize the recovery of receivables in the shortest period of time possible, thereby properly discharging departmental stewardship responsibilities.

The audit found that a dunning process is not in place to pursue timely collection of active and aged receivables. The Department had approximately $14.7M in outstanding receivables, with 52% past due for over one year, and Accounting Operations is not taking timely actions to pursue these.

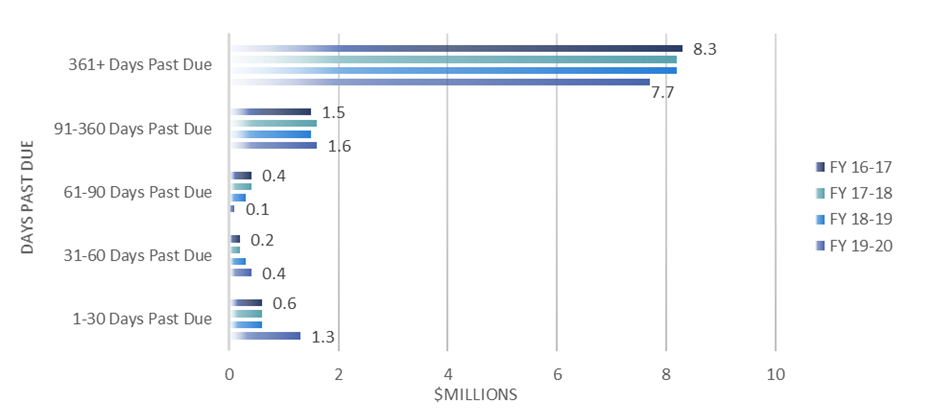

For the fiscal year-end 2019-2020, the $14.7M in outstanding receivables was made up of approximately 972 accounts with an average value of $15.1k. $7.7M was past due for over 365 days, which represents 667 accounts with an average value of $11.6k. The AR decreased only by 1% Year over Year (YoY) since the previous fiscal year and by an average of 0.10% YoY since the fiscal year 2016-2017. Exhibit 1 provides visualization with respect to aging of receivables over the last four (4) fiscal years. The MAF 2018-19 Departmental Report for Fisheries and Oceans Canada also indicated that in 2017-18, 49% of DFO’s non-tax accounts receivable was outstanding for more than 365 days. The audit did not observe significant improvement in these numbers.

Currently, there is no dunning process and collection is limited to sending out monthly statements without active follow-ups with clients or procedures to restrict or halt service when outstanding debt is present. A dunning process refers to methodically communicating with customers to ensure the collection of accounts receivable.

Exhibit 1: Majority of the Receivables Remain Outstanding over 365 days

Description

The graph above represents the value (in millions of dollars) of DFO’s outstanding receivables that were past due for fiscal year 2016-17, fiscal year 2017-18, fiscal year 2018-19, and fiscal year 2019-20. Each bar presents the total value (in millions of dollars) of DFO’s outstanding receivables that was past due for 1-30 days, 31-60 days, 61-90 days, 91-360 days, or more than 361 days. For outstanding receivables that were 361 days or more past due, the total value decreased from $8.3 million in fiscal year 2016-17 to $7.7 million in fiscal year 2019-20. For outstanding receivables that were 91-360 days past due, the total value increased from $1.5 million in fiscal year 2016-17 to $1.6 million in fiscal year 2019-20. For outstanding receivables that were 61-90 days past due, the total value decreased from $0.4 million in fiscal year 2016-17 to $0.1 million in fiscal year 2019-20. For outstanding receivables that were 31-60 days past due, the total value increased from $0.2 million in fiscal year 2016-17 to $0.4 million in fiscal year 2019-20. For outstanding receivables that were 1-30 days past due, the total value increased from $0.6 million in fiscal year 2016-17 to $1.3 million in fiscal year 2019-20.

Carrying a significant volume of ageing accounts receivable presents a risk to the Department of uncollectable revenue. If DFO is not collecting on its accounts receivable, it can harm DFO’s reputation in dealing with clients equitably. If some clients do not pay after receiving services and DFO is not actively collecting on these amounts, this lacks fairness to clients that paid on time for the same service. In addition, it may encourage more clients to withhold payment.

The audit also noted a gap in controls that could lead to a risk of fraud. There is currently a lack of monitoring controls over third-party collections to ensure timely and accurate remittance of all revenues earned by DFO. The main third-party collection is for Marine Services Fees (MSF) related to Foreign East vessels where shipping agents create the invoice and collect fees on DFO’s behalf and charge a 5% agent’s fee per invoice for this service. Agents then complete a remittance summary form along with trip invoices and remit payment to Accounting Operations. DFO relies on the agent to invoice, collect, report, and remit honestly, accurately and in a timely manner. Currently there are no periodic reviews or monitoring done to validate the accuracy of the invoicing and processing of fees by the shipping agents. This presents a risk to the Department of agents misrepresenting the amount collected and remitting less than the actual amount invoiced and collected. MSF Foreign East fees account for the highest revenue among all MSF categories, with over 100 third-party agents collecting on behalf of DFO totaling approximately $16M in revenue in FY 19-20.

Write-offs

Section 4.3.7 of the TB Directive on Public Money and Receivables states that the CFO or the senior departmental managers designated by the deputy head are responsible for taking timely action for write-offs. A write-off is defined in the Directive as an accounting action that reduces the amount of account receivable of a department or agency regarding a debt, or a part of a debt, that has been determined to be un-collectable.

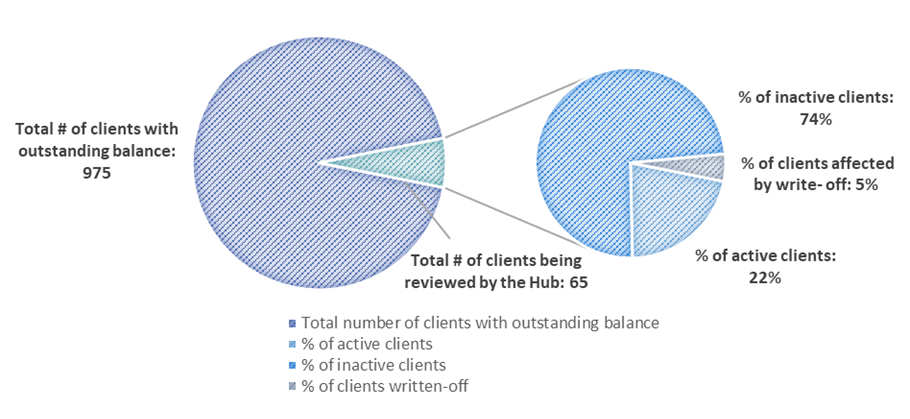

The audit found that write-offs are not completed on a timely basis. Of 65 clients that Accounting Operations reviewed for write-off, 74% of the clients are inactive meaning that they have not made any payments in the last 365 days, totalling approximately $6M in outstanding payments and more than 46% of clients have not made any payment over the past two years. For FY 19-20, total write-offs amounted to $1.1M affecting three clients (5% of the 65 clients). Considering the statute of limitation, several of these outstanding payments are now statute-barred and should have been written-off. The audit found write-off of accounts that were not initiated until several years after it had been statute-barred. There are accounts from the 1990s and 2000s that have not been written off totaling $1M. Exhibit 2 provides a visualization of active and inactive clients with outstanding balances over 365 days for the FY ended 2019-20.

The audit also found that currently there are no performance metrics to support the management of receivables. The TB Guide for Managing Receivables states that reports on receivables are also a source of information when establishing and monitoring a results-based measurement mechanism to manage receivables. Reports on receivables should include the recovery rate of accounts receivable; the default rate; the average number of days for which accounts receivable are outstanding; and the departmental collection costs per dollar of outstanding receivables collected.

Exhibit 2: Majority of inactive client accounts with outstanding receivables have not been written-off

Description

The chart above shows that there were a total of 975 clients with outstanding balances as of the end of fiscal year 2019-20. Out of the 975 clients, there were 65 clients that were reviewed for write-off by Accounting Operations. Out of the 65 clients, 48 clients (74%) were inactive clients, meaning that they have not made a payment on the outstanding balance in the last year, 14 clients (22%) were active meaning that they have made a payment on the outstanding balance in the last year, and 3 clients (5%) had their outstanding balances written off.

Timely collection and write-off actions and effective monitoring of account receivables would allow for the department to properly discharge its departmental stewardship responsibilities.

Revenues are not always processed accurately in compliance with legislation and policies

The DFO Directive on Public on Accounts Receivable, Revenues and Deferred revenues requires that a complete audit trail of receipt, deposit and recording processes must be in place to ensure that accounting entries are generated, authorized and supported by source documents that provide objective evidence and proper authorization of transactions. In addition, an audit trail permits tracing of any transaction from its inception to final outcome and from accounting records back to original transaction.

The audit selected a judgmental sample of 37 transactions to assess internal controls to ensure that revenue transactions were processed and authorized in compliance with legislation and policies. A review of the sampled transactions indicated gaps in controls over documenting audit trails, authorizations and availability of source documentation.

The audit found instances whereby source documents such as cashbooks and invoice request forms to support accounting entries were missing authorizations. Cashbooks are completed by the programs and sent to Accounting Operations to account for payments received by the Department. These are used by Accounting Operations to record payment information in Abacus. Invoice request forms are required for certain types of transactions that are not invoiced by Accounting Operations. These include Domestic Tonne/KM, Dredging and Eastern Foreign Manual. For these transactions, invoice request forms are filled out by Accounting Operations which then creates an actual invoice based on the information on the form. Accounting Operations then sends out the invoice to the client.

The audit also found that there are no standardized approval processes and documented authorities for approving transactions and the granting of credit memos. Some regions and programs stated that cashbooks are not required to be signed while others stated that it was not clear if it is required and at what level. There are also no documented authorities for approving credit memos. Credit memos are completed daily by Accounting Operations to fix issues such as invoicing the wrong client at the request of the Marine Services Fees Billing Collection and Compliance (MSFBCC). For dredging and icebreaking services fees, the redirection rate for FY 2019-20 was around 9% for each fee (total of 638 invoices out of 7294). Each redirected invoice represents that the original invoice had to be reversed and a credit memo had to be applied for the full amount of the invoice.

Defining and communicating document submission and approval requirements for processing of revenue transactions would allow for tracing, verification and accountability for transactions and would decrease the potential risk of financial loss to the department due to late deposits or missing payments.

Recommendation 2: The Assistant Deputy Minister and Chief Financial Officer should ensure that:

- the process to pursue active and aged receivables is strengthened to allow for timely recovery or write-off

- key performance metrics are established to track, monitor and report on receivables and write-offs

Recommendation 3: The Assistant Deputy Minister and Chief Financial Officer in collaboration with programs and regions should establish an oversight mechanism over third party agents who are responsible for collecting on DFO's behalf

Recommendation 4: The Assistant Deputy Minister and Chief Financial Officer should further clarify and communicate document submission and approval requirements for processing of revenue transactions to the programs and regions.Appendix A: Lines of enquiry and audit criteria

The audit criteria were developed from the following sources:

- Service Fees Act

- Debt Write-off Regulations

- Treasury Board Policy on Financial Management

- Treasury Board Directive on Public Money and Receivables

- Treasury Board Directive on Charging and Special Financial Authorities

- DFO Policy on Accounts Receivable, Revenues and Deferred Revenues

- DFO Directive on Accounts Receivable, Revenues and Deferred Revenues

| Audit Criteria | Conclusion |

|---|---|

| Line of Enquiry 1 – Governance | |

| Criterion 1.1:Authorities, responsibilities and accountabilities related to revenue management are clearly defined and communicated. | Partially Met |

| Criterion 1.2:Performance measures are linked to planned results. | Partially Met |

| Criterion 1.3:Monitoring is performed to ensure accuracy and completeness of revenue related financial information | Partially Met |

| Line of Enquiry 2 – Internal Controls | |

| Criterion 2.1:Revenues are collected in a timely manner in compliance with legislation and policies. | Partially Met |

| Criterion 2.2:Revenues are processed accurately for the period they were earned in compliance with legislation and policies. | Partially Met |

Appendix B: Recommendations and Management Action Plans

At DFO, the revenue management’s roles and responsibilities are shared between the CFO Sector, Strategic Policy and the respective programs that generates the revenues. These roles and responsibilities have been presented and supported at past presentations to FIMC and POC. At the moment, Strategic Policy is responsible to provide the strategic vision for service fees, the CFO Sector is responsible for the direction related to the stewardship of the fees, while the programs are responsible to manage the business operations of the fees. Based on the department’s roles and responsibilities, the recommendations in the management action plan are collaborative between the different sectors and areas where participation of other sectors than the CFO Sector is required have been identified.

| Recommendations | Action Plan | Responsible Manager (s) | Deliverables | Planned Completion Date |

|---|---|---|---|---|

| Recommendation 1: The Assistant Deputy Minister and Chief Financial Officer should update governance to strengthen departmental revenue management activities. |

1. CFO Sector will work with the Governance Secretariat to review the Terms of Reference for POC and FIMC and update roles and responsibilities if required. |

Director, Financial Authorities Management and Governance Secretariat | Decision from Governance Secretariat on updating FIMC and POC TORs | September 30, 2021 |

2. CFO Sector will increase communication by establishing templates and schedules to formally communicate the annual fee adjustments to programs and by publishing on the intranet additional information on roles and responsibilities for revenue management. |

Director, Financial Authorities Management | Documented communication material | July 30, 2021 | |

3. CFO Sector, in collaboration with each Program, will further document procedures, including:

|

Director, Financial Authorities Management | Documented procedures Update of year-end procedures |

July 30, 2021 January 15, 2022 |

|

4. CFO Sector will report on results of the first service fee review and return to FIMC and POC for changes in process and plan for future service fee reviews. |

Director, Financial Authorities Management | Record of Decision for FIMC and POC | September 30, 2021 | |

| Recommendation 2: The Assistant Deputy Minister and Chief Financial Officer should ensure that:

|

1a. The CFO Sector, in collaboration with each Program, will review current collection practices and challenges and report findings to Management. 1b. The CFO Sector will review its debt write off governance process and update if required the departmental delegation of authority to ensure timeless of write-off. 2. The CFO Sector will establish key performance metrics to track, monitor and report on receivables and write offs which will be presented to the departmental Debt Write Off Committee on a semi-annual basis. |

Director, Accounting Operations | Report to Management: i) Updated ToR debt-write off ii) Updated delegation of authority Report to Debt Write-Off Committee |

March 31, 2022 |

| Recommendation 3: The Assistant Deputy Minister and Chief Financial Officer in collaboration with programs and regions should establish an oversight process over the third party agents who are responsible for collecting on DFO's behalf. |

The CFO Sector, in collaboration with Programs, will undertake a review of the oversight process over the third party agents who are responsible for collecting fees on behalf of DFO. | Director, Accounting Operations | Report to Management | May 30, 2022 |

| Recommendation 4: The Assistant Deputy Minister and Chief Financial Officer should ensure that document submission and approval requirements for processing of revenue transactions are clearly defined and communicated to the programs and regions. |

The CFO Sector will formally communicate procedural requirements for timeliness, retention and approval of supporting documents and cashbooks to programs. | Director, Accounting Operations | i) Communiqué to programs ii) Updated procedures |

Dec 31, 2021 |

- Date modified: